Go back

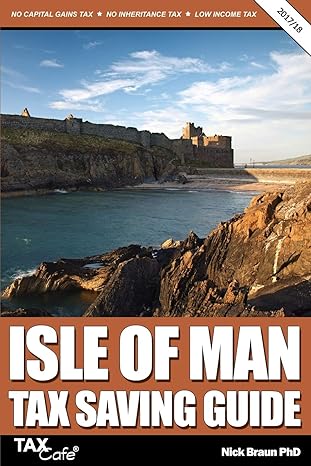

Tax Planning For Non Residents And Non Doms(2019 Edition)

Authors:

Nick Braun

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $58.36

Savings: $58.36(100%)

Book details

ISBN: 1911020323, 978-1911020325

Book publisher: Taxcafe UK Ltd (August 7, 2018)

Get your hands on the best-selling book Tax Planning For Non Residents And Non Doms 2019 Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Tax Planning For Non Residents And Non Doms 2019 Edition Summary: Up to date with all the latest tax changes from 2017 and 2018.This unique tax guide shows you how to reduce your tax bill if you are non-UK resident or non-domiciled.Subjects covered include:All recent tax changes affecting non-residents and non domsHow the Statutory Residence Test worksIncome tax planning for non-residentsCapital gains tax planning for non-residentsThe new CGT rules for non-residents selling UK propertyMore property tax changes coming in 2019How to save tax when you retire abroad or work abroadFull details of the brand new tax regime (from April 2017) for non-domiciled individualsHow non doms can pay less income tax, capital gains tax and inheritance taxThe tax benefits of offshore trusts

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Ammr makki

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."