Go back

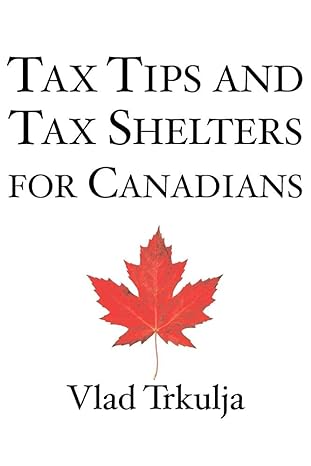

Tax Tips And Tax Shelters For Canadians(1st Edition)

Authors:

Vlad Trkulja

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $16.95

Savings: $16.95(100%)

Book details

ISBN: 1897178565, 978-1897178560

Book publisher: Idiomatic (January 9, 2009)

Get your hands on the best-selling book Tax Tips And Tax Shelters For Canadians 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Tax Tips And Tax Shelters For Canadians 1st Edition Summary: Tax Tips and Tax Shelters for Canadians provides individuals and business owners with effective tax-planning strategies designed to reduce taxable income, generate tax deductions, increase tax refunds, increase potential investment returns, defer tax, increase wealth, and minimize probate and estate taxes. When implemented properly the strategies discussed in this book are legitimate tax-planning strategies recognized by many financial planners, financial experts, chartered accountants, actuaries, financial commentators, tax lawyers, and the Canada Revenue Agency. Although RRSPs are the most popular tax shelter in this country, individuals and business owners are not taking advantage of many simple products, services, and structures that can provide immediate tax relief and benefits. Learn more about the following strategies in Tax Tips and Tax Shelters for Canadians: -Individual Pension Plans -Retirement Compensation Arrangements -ROC funds -Corporate class funds -RRSP/RRIF meltdown and drawdown strategies -Flow-through investments -Super flow-through investments -Immigration trusts -Probate and estate taxes -Incorporating your business or professional practice -Trust accounts -RRSPs and RRIFs -and much more

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Michelle Duran

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."