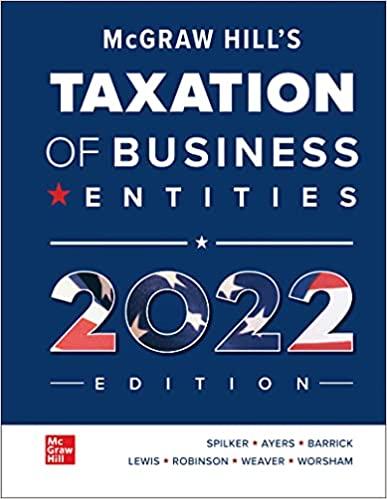

Taxation Of Individuals And Business Entities 2020(11th Edition)

Authors:

Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Type:Hardcover/ PaperBack / Loose Leaf

Condition: Used/New

In Stock: 1 Left

Shipment time

Expected shipping within 2 - 3 DaysPopular items with books

Access to 35 Million+ Textbooks solutions

Free ✝

Ask Unlimited Questions from expert

AI-Powered Answers

30 Min Free Tutoring Session

✝ 7 days-trial

Total Price:

$0

List Price: $38.76

Savings: $38.76

(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Taxation Of Individuals And Business Entities 2020

Price:

$9.99

/month

Book details

ISBN: 1259969614, 978-1259969614

Book publisher: McGraw Hill

Offer Just for You!:

Buy 2 books before the end of January and enter our lucky draw.

Book Price $0 : The 'Taxation Of Individuals And Business Entities 2020' by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, and Connie Weaver offers a comprehensive exploration into the taxation processes that affect both individuals and corporate entities. This 11th edition not only delves into the latest tax laws but also provides thorough explanations on how these laws impact financial decision-making and planning. The textbook covers a wide range of topics such as gross income inclusion, tax deductions, credits, and the calculation of taxable income, thus making it an essential resource for students and professionals in the field of accounting and finance. A unique feature of this edition is its integrated solution manual and detailed Answer Key, which facilitate enhanced understanding and application of complex tax concepts. Furthermore, the book comes with a well-organized table of content, ensuring that users can easily navigate through the various chapters and sections. The methodologies discussed in this text prepare learners to tackle real-world tax scenarios using up-to-date approaches and regulations, equipping them with the necessary skills to succeed in modern tax environments. This book has garnered positive reception for its practical approach to teaching complex taxation topics, which are crucial for anyone aspiring to excel in accounting, finance, and related fields. To assist in learning, the authors recommend their cheap solution manual as a cost-effective study aid.

Customers also bought these books

Popular Among Students

Customer Reviews

Trusted feedback from verified buyers

JH

The book is decent enough for a foundational understanding of tax laws but falls short in keeping the reader engaged due to its dense content. It'd be better with more updated examples.

AT

The 'Taxation Of Individuals And Business Entities 2020' provides an excellent balance of theory and practical application. The book's organization is logical, with each chapter building on the last, which makes it great for both self-study and course use. I got it with a subscription discount, which was a nice bonus. Apart from a couple of minor issues in a few examples, it's a top-notch resource. Delivery was swift, making for a seamless experience.

JR

This book is an absolute must-have for anyone involved in taxation, whether you're a student or a practicing accountant. The explanations are clear, and the examples provided are incredibly useful for applying complex concepts in real-world scenarios. I appreciated the thorough explanations of recent tax legislation and how they impact both individuals and businesses. The book also arrived quickly and was well-packaged, ensuring it arrived in perfect condition. Highly recommended!

IP

This book serves as a comprehensive guide for understanding the complexities of taxation. It does a great job of explaining the recent changes in tax laws. The examples are particularly insightful and help in grasping difficult concepts. I bought it through my member account and appreciated the extra discount. Although there are some areas that felt a bit dense, it is overall a valuable resource for tax students and professionals alike.