Go back

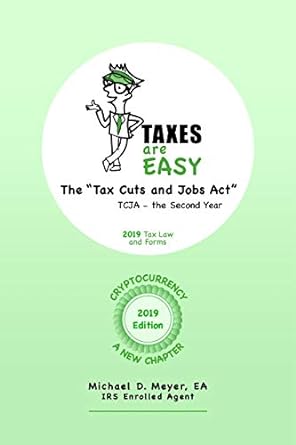

Taxes Are Easy The Tax Cuts And Jobs Act Tcja The Second Year 2019 Tax Law And Forms(1st Edition)

Authors:

Michael D Meyer Ea

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $14.95

Savings: $14.95(100%)

Book details

ISBN: 057863080X, 978-0578630809

Book publisher: Michael D Meyer , EA (January 2, 2020)

Get your hands on the best-selling book Taxes Are Easy The Tax Cuts And Jobs Act Tcja The Second Year 2019 Tax Law And Forms 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Taxes Are Easy The Tax Cuts And Jobs Act Tcja The Second Year 2019 Tax Law And Forms 1st Edition Summary: The “Tax Cuts and Jobs Act” TCJA passed by Congress and signed by President Trump on December 22, 2017, enacted significant tax law changes that began to affect the 2018 tax year. Many of these changes continue through to the 2025 tax year. This book explains 42 topics of TCJA-related changes that could affect your 2019 “U.S. Individual Income Tax Return.”The major topic categories explained in the ten chapters are:• The new 2019 IRS Form 1040 and Form 1040-SR with their three new supporting Schedules. • Changes to the 2019 Income Tax Rate Schedules and 2019 Capital Gain Tax Rate Schedule. • Explanations of the 2020 W-4 Withholding calculators and making Estimated Tax Payments. • Personal Exemption, Child Tax Credit, and Credit for Other Dependents changes. • Standard Deduction amounts updated for 2019 and 12 Itemized Deduction changes explained. • Eight Expired, Suspended, Eliminated or Modified Adjustments and Deductions explained. • Six Deductions/Exclusions/Credits restored for the 2018/2019/2020 tax years. • Expanded 529 Qualified Tuition Program plan distributions and ABLE Account contributions. • The Roth IRA recharacterization rules and the Backdoor Roth IRA explained. • Affordable Care Act changes to the Tax Penalty for not having Qualified Health Insurance. • High-Earner income changes to the Kiddie Tax and the Alternative Minimum Tax. • Updated values for the 2019 Estate and Gift Tax and $15,000/year Gift Tax Exclusion amount. • The new 20% Qualified Business Income deduction for unincorporated small businesses with six examples how to calculate this new business deduction, using the new Form 8995-series. • Small business Depreciation rule changes with four examples for business vehicle depreciation in the 2019 tax year, and a discussion of the pros and cons of leasing a business vehicle. • Meals and Entertainment deduction changes for small business.• Like-Kind Exchanges now only allowed for business and investment real estate assets.• Supplemental wages like bonuses now subject to a lower 22% tax withholding rate. • A new chapter on Cryptocurrencies, that explains how they work, the many ways you can acquire a Cryptocurrency, and how the sale, spending, and exchange of Cryptocurrencies is reported on the 2019 tax return. The IRS in 2019 asks if you had virtual currency activity as a Yes/No question at the top of the Schedule 1. The IRS treatment of Cryptos is explained.Each chapter begins with a full TOPICS SUMMARY so you can do a quick review of all 42 of the TCJA-related changes just by reading the first few pages of each of the ten chapters. Throughout the book you will also notice 111 underlined web Hyperlinks to articles, websites and IRS tax forms — linked to Internet research references for most of the topic explanations.The purpose of this book is to give you a very good overview and explanation of 42 of the TCJA-related changes that can affect your 2019 “U.S. Individual Income Tax Return.” These changes began with the 2018 tax year with most continuing through to the 2025 tax year.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Jean Koffi

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."