Go back

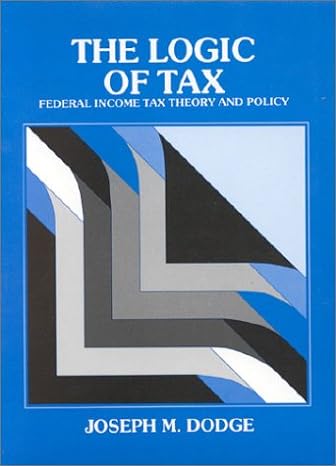

The Logic Of Tax Federal Income Tax Theory And Policy(1st Edition)

Authors:

Joseph M. Dodge

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $55.93

Savings: $55.93(100%)

Book details

ISBN: 0314558683, 978-0314558688

Book publisher: West Group (January 1, 1989)

Get your hands on the best-selling book The Logic Of Tax Federal Income Tax Theory And Policy 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

The Logic Of Tax Federal Income Tax Theory And Policy 1st Edition Summary: Income taxation explained in conceptual terms: the idea of ?income? (the same taxpayer?s dollars should not be taxed twice or deducted twice); economics (efficiency and welfare); tax fairness (ability to pay); business accounting principles; and the time?value-of?money concept. Virtually all features of the tax system (except certain line?drawing issues) are explained with reference to these central concepts. An easily?understood treatise designed to be used by readers not particularly interested in learning all the technical details. The relevant concepts of accounting, financial theory and economics are introduced only on a ?need to know? basis.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Joe Ward

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."