Go back

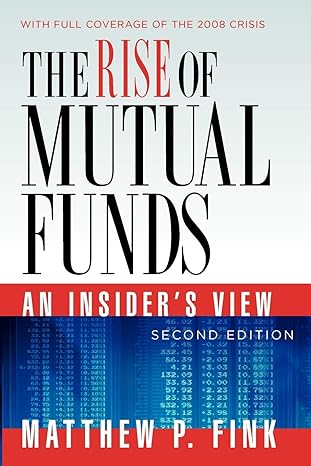

The Rise Of Mutual Funds An Insiders View(2nd Edition)

Authors:

Matthew P. Fink

Cover Type:Hardcover

Condition:Used

In Stock

Include with your book

Free shipping: April 04, 2024Popular items with books

Access to 3 Million+ solutions

Free ✝

Ask 10 Questions from expert

200,000+ Expert answers

✝ 7 days-trial

Total Price:

$0

List Price: $14.21

Savings: $14.21(100%)

Book details

ISBN: 0199753504, 978-0199753505

Book publisher: Oxford University Press

Get your hands on the best-selling book The Rise Of Mutual Funds An Insiders View 2nd Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

The Rise Of Mutual Funds An Insiders View 2nd Edition Summary: In 1940 few Americans had heard of mutual funds. Today U.S. mutual funds are the largest financial industry in the world, with over 88 million shareholders and over $11 trillion in assets. New and updated to reflect the crash of 2008, Matthew Fink's latest book, The Rise of Mutual Funds: An Insider's View, Second Edition describes the developments that have produced mutual funds' long history of success. Among these developments are:* formation of the first mutual funds in the roaring 20s* how the 1929 stock market crash, a disaster for most financial institutions, spurred the growth of mutual funds* establishment in 1934, over FDR's objection, of the United States Securities and Exchange Commission, the federal agency that regulates mutual funds * enactment of the Revenue Act of 1936, the tax law that saved mutual funds from extinction* passage of the Investment Company Act of 1940, the "constitution" of the mutual fund industry* the creation in 1972 of money market funds, which totally changed the mutual fund industry and the entire U.S. financial system *enactment of the Employee Retirement Income Security Act of 1974, which created Individual Retirement Accounts* the accidental development of 401(k) plans, which have revolutionized the way Americans save for retirement* the 2003 trading abuses, the greatest scandal ever in the history of the mutual fund industry Many events have never been discussed in detail; others have been discussed in works on other subjects. This is the first book that pulls together the many strands of mutual funds' unique history, written by an expert who draws on forty years of personal experience in the fund industry.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Michelle Duran

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."