Question: The 2015 comparative income statement and the 2015 comparative balance sheet of Golf America, Inc. have just been distributed at a meeting of the companys

The 2015 comparative income statement and the 2015 comparative balance sheet of Golf America, Inc. have just been distributed at a meeting of the company’s Board of Directors. The members of the board raise a fundamental question: Why is the cash balance so low? This question is especially hard to understand because 2015 showed record profits. As the controller of the company, you must answer the question.

Requirements

1. Prepare a statement of cash flows for 2015 in the format that best shows the relationship between net income and net operating cash flow. The company sold no plant assets or long- term investments and issued no notes payable during 2015. There were no non-cash investing and financing transactions during the year. Show all amounts in thousands.

2. Considering net income and the company’s cash flows during 2015, was it a good year or a bad year? Give your reasons.

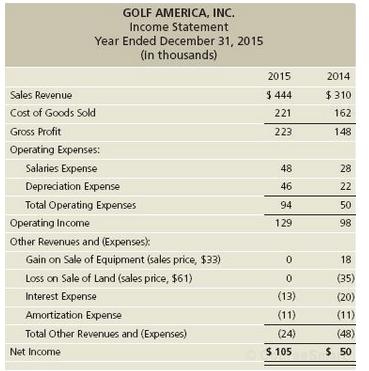

GOLF AMERICA, INC. Income Statement Year Ended December 31, 2015 (in thousands) 2015 2014 Sales Revenue $ 444 $ 310 Cost of Goods Sold 221 162 Gross Profit 223 148 Operating Expenses: Salaries Expense 48 28 Depreciation Expense 46 22 Total Operating Expenses 94 50 Operating Income 129 98 Other Revenues and (Expensesk Gain on Sale of Equipment (sales price, $33) 18 Loss on Sale of Land (sales price, $61) (35) Interest Expense (13) (20) Amortization Expense (11) (11) Total Other Revenues and (Expenses) (24) (48) Net Income $ 105 S 50

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Requirement 1 GOLF AMERICA INC Statement of Cash Flows Year Ended December 31 2015 in thousands Cash ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

389-B-M-A-S-C-F (2870).docx

120 KBs Word File