The accountants at Johnny's Jackets are considering switching from traditional costing to activity based costing and need

Question:

The accountants at Johnny's Jackets are considering switching from traditional costing to activity based costing and need to calculate and compare the unit costs of their top two products: leather jackets and wool sweaters. The store budgeted their overhead to be $4,500,000, which was traditionally allocated using machine hours, which were budgeted at 55,000.

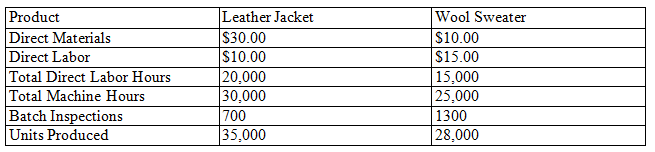

Below is the information the accountants collected regarding their two products:

What is the unit cost of both products under the Traditional method? (Round all calculations to two decimal places)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Cost Management Measuring Monitoring and Motivating Performance

ISBN: 978-0470769423

2nd edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott

Question Posted: