Question: The accounting records for Juan Electric Corporation contained the following balances as of December 31, 2010: The following accounting events apply to Juan Electric Corporation?s

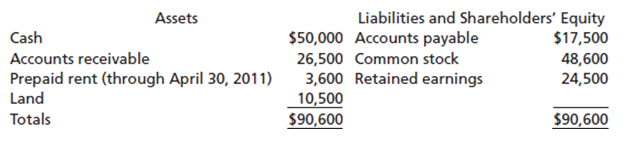

The accounting records for Juan Electric Corporation contained the following balances as of December 31, 2010:

The following accounting events apply to Juan Electric Corporation?s 2011 fiscal year:

January 1 Juan Electric purchased a computer that cost $18,000 for cash. The computer had no salvage value and a three-year useful life.

March 1 The company borrowed $20,000 by issuing a two-year note at 3%.

May 1 The company paid $6,000 cash in advance for an eight-month lease for office space. The lease started immediately.

June 1 The company paid cash dividends of $2,000 to the shareholders.

July 1 The company purchased land that cost $15,000 cash.

August 1 Cash payments on accounts payable amounted to $6,000.

1 Juan Electric received $6,000 cash in advance for 12 months of service to be performed monthly, beginning on receipt of payment.

September 1 Juan Electric sold land for $13,000 cash. The land originally cost $15,000.

October 1 Juan Electric purchased $1,300 of supplies on account.

November 1 Juan Electric purchased a one-year, $10,000 certificate of deposit at 3%.

December 31 The company earned service revenue on account during the year that amounted to $50,000.

31 Cash collections from accounts receivable amounted to $46,000.

31 The company incurred other operating expenses on account during the year that amounted to $6,000.

Also: Salaries that had been earned by the sales staff but not yet paid amounted to $2,300.

There were $200 worth of supplies on hand at the end of the period.

Based on the preceding transaction data, there are some additional adjustments that need to be made before the financial statements can be prepared.

Liabilities and Shareholders' Equity $17,500 Assets Cash Accounts receivable Prepaid rent (through April 30, 2011) Land Totals $50,000 Accounts payable 26,500 Common stock 3,600 Retained earnings 10,500 $90,600 48,600 24,500 $90,600

Step by Step Solution

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Date 1Jan 1Mar 1May 1Jun 1Jul Computer Cash Cash Land Note payable Prepaid rent Cash Dividends Journal Entry Cash Cash DR 18000 20000 6000 2000 15000 CR 18000 20000 6000 2000 15000 1Aug 1Sep 1Oct 1Nov ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

323-B-A-A-C (4277).docx

120 KBs Word File