The accrual basis Four Winds Partnership owned and operated three storage facilities in Milwaukee, Wisconsin. The partnership

Question:

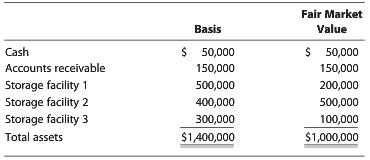

The accrual basis Four Winds Partnership owned and operated three storage facilities in Milwaukee, Wisconsin. The partnership did not have a § 754 election in effect when partner Taylor sold her 25% interest to Patrick for $250,000. The partnership has no debt. There are no § 197 assets, and assume that there is no depreciation recapture potential on the storage facility buildings. At the time of the transfer, the partnership's asset bases and fair market values were as follows:

The value of two of the properties is less than the partnership's basis because of downturns in the real estate market in the area. Patrick's share of the inside basis of partnership assets is $350,000, and his share of the fair market value of partnership assets is $250,000.

a. What adjustment is required regarding Patrick's purchase of the partnership interest? Must a § 754 election be made? Why or why not?

b. Using the basis allocation rules of § 755 and the Regulations there under, calculate the amount of the total adjustment to be allocated to each of the partnership's assets.

c. Would an adjustment be required if the partnership was a venture capital firm and, instead of storage facilities, its three primary assets were equity interests owned in target firms? What requirements would have to be satisfied to avoid making a basis adjustment?

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

ISBN: 9781305399884

39th Edition

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young