The ATCO Company purchased the Dexter Company three years ago. Prior to the acquisition, Dexter manufactured and

Question:

The ATCO Company purchased the Dexter Company three years ago. Prior to the acquisition, Dexter manufactured and sold plastic products to a wide variety of customers. Since becoming a division of ATCO, Dexter only manufactures plastic components for products made by ATCO’s Macon division.

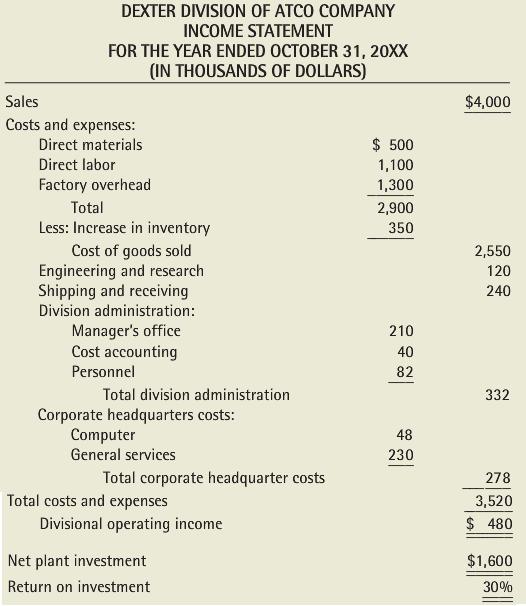

Macon sells its products to hardware wholesalers. ATCO’s corporate management gives the Dexter division management a considerable amount of authority in running the division’s operation. However, corporate management retains the authority for decisions regarding capital investments, price setting of all products, and the quantity of each product to be produced by the Dexter division. ATCO has a formal performance evaluation program for the management of all of its divisions. The performance evaluation program relies heavily on each division’s return on investment. The accompanying income statement of Dexter division provides the basis for the evaluation of Dexter’s divisional management.

The corporate accounting staff prepares all of the divisions’ financial statements. The corporate general services costs are allocated on the basis of sales dollars, and the computer department’s actual costs are apportioned among the divisions on the basis of use. The net division investment includes division fixed assets at net book value (cost less depreciation), division inventory, and corporate working capital apportioned to the division on the basis of sales dollars.

REQUIRED

A. Discuss the financial reporting and performance evaluation program of ATCO Company as it relates to the responsibilities of the Dexter division.

B. Based upon your response to part (A), recommend appropriate revisions of the financial information and reports used to evaluate the performance of Dexter’s divisional management. If you conclude that revisions are not necessary, explain why they are not needed.

Step by Step Answer:

Cost Management Measuring Monitoring and Motivating Performance

ISBN: 978-0470769423

2nd edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott