The Company Lalo Company, headquartered in Vaduz, is a company listed in Amsterdam, Paris and Zurich. It

Question:

The Company

Lalo Company, headquartered in Vaduz, is a company listed in Amsterdam, Paris and Zurich. It is the third largest small home appliance manufacturer in Europe. The company was founded in 1955 by Patrick O’Share, a self-made millionaire, whose family emigrated from Ireland during the 1930s. Despite Lalo being a public company, the O’Share family still holds a significant interest in the company through the ownership of 20 percent of the outstanding voting shares. The remainder of the shares is actively traded and the stock ownership is diversified. Patrick O’Share, now 70 years old, serves in the largely honorary position of Chairman of the Board. His eldest daughter, Minnie Mize (her married name), 45, is the current President and Chief Executive Officer.

The company has a 31 December fiscal year-end. Today is 10 January X2 and the books for year X1 are about to be physically closed (as of 31 December X1). All normal and recurring transactions have been recorded in the accounts and a preliminary balance sheet and income statement have been prepared (see Exhibits 1 and 2).

Eric Faithful, Vice President of Finance, has organized a meeting to discuss several issues concerning seven year-end adjustments and closing entries. All parties interested in the year-end adjusting entries have been invited to attend. The meeting will include, among others, Eric Faithful, Minnie Mize (CEO), Max E. Mumm (Vice President for Investor Relations), Celia Vee (Vice President for Sales) and Gunther Somday (Vice President for Production).

Key players

After graduating from a French Graduate School of Business, Eric Faithful, after a tough exam, qualified as a Certified Public Accountant. He worked as an Audit Supervisor for a ‘Big Four’ accounting firm in Frankfurt before joining Lalo two years ago. In his opinion, compliance with the letter and spirit of generally accepted accounting principles is essential. He is opposed to any form of manipulation of the accounts. He often declares: ‘Our mission is to give a clear and truthful view of the financial position and results of operations of the company’.

Minnie Mize is the daughter of the founder of the Company. She progressed through the ranks from being a salesperson to her current position as President and CEO. She is a firm believer, especially in the difficult economy that affects the globe at this time, in reinvesting profits and generating enough operating cash flows to support growth without having to depend too much on external financing. Her philosophy is that the accounting experts should ‘use conservative accounting methods and take advantage of all legal loopholes to minimize reported and taxable income and avoid unnecessary drains on the cash flow of the company. A better future for all comes from our ability to generate and reinvest as large a cash flow as possible’.

After five years in the Investor Relations Department of a large North American conglomerate, Max E. Mumm assumed the position of Vice President for Investor Relations at Lalo approximately 12 months ago. He has been critical of what he sometimes refers to as the ‘lack of vision of the family’. He believes that presenting the company in the most favorable light, and maintaining effective communications with financial analysts and the investment community, are key to the Company’s success. ‘If we are to continue expanding in the face of increased international competition and the consolidation trend in the industry in this depressed economic environment, we are going to need to obtain additional equity capital. We must keep the loyalty of our shareholders and attract new ones. It is essential for a growing business like ours to earn a high return on equity in order to lower our cost of capital’. Minutes of the meeting Item on the agenda: Seven adjusting entries still need to be finalized and this is the major objective of the meeting.

1. Depreciation Eric Faithful: ‘Last 1 July, we purchased a new sheet metal press for one million CU. The cost of the press was added to property, plant and equipment, but no decision has been made yet about its useful life or depreciation. Gunther, what do you think of the useful life

of this press?’

Gunther Somday (VP-Production): ‘Technically the useful life of the press should be between five and ten years. Although I do not want to interfere with your accounting discussion, I know we have to choose between a straight-line and an accelerated method of depreciation.’

Minnie Mize: ‘This is a no-brainer, let’s choose the accelerated method and let’s do it over the shortest acceptable life, i.e., five years here. The machine will become obsolete in a few years and I’d rather depreciate it to the maximum before we have to scrap or replace it, or at least, as soon as we have benefited from all the production that we’re going to get from the machine. Eric, I believe we should multiply the straight-line amount by two to get the accelerated amount, is that right?’

Eric Faithful: ‘Yes, it would be two, if we use double declining balance depreciation. That would give a depreciation rate equal to twice as much as straight-line. This rate would be applied to the remaining balance, until you have to switch back to straight-line when the amount of depreciation expense is lower than the straight-line amount calculated over the remaining years. Of course, whatever method of depreciation we choose, we must start depreciating as of 1 July X1.’

Max E. Mumm: ‘I don’t agree with that approach. This machine, when we bought it, had a life expectancy of at least ten years. With our projected sales demand we can use the machine’s capacity for at least ten years to come. And, on top of that, I hear it’s a good machine with a technology that will not become obsolete that soon. Based on these facts, I feel the straight-line ethod is the one that is most appropriate. In addition, analysts tell me that straight-line depreciation is the method that is most commonly used by our competitors. Furthermore, if we choose to depreciate the machine over ten years, we will show a better bottom line. If the machine were to become obsolete, we could just expense the remaining un-depreciated book value at that point in time. Why penalize ourselves now in the eyes of shareholders?’

Eric Faithful: ‘I don’t necessarily agree with either of you. Our accounting methods should reflect as well as possible the actual position of the company. Gunther says that given the new products in the pipeline, he expects to use the machine at least for the next eight years, but beyond that he is not sure we’ll still use this technology. I would therefore suggest we take the eightyear time frame into consideration in our decision about depreciation. As for the method of depreciation, the accelerated method seems to me to be the most appropriate because the market indicates that the resale value of the machine falls off dramatically after the first year of operation. I second Minnie’s motion in favor of the double-declining balance method.’

2. Allowance for doubtful accounts Eric Faithful: ‘A 200,000 CU invoice for a sale of microwaves that we made last 15 May to Worldapart is still outstanding and the receivable is still unpaid. The sales people estimate that, in all probability, we will not collect more than 10 percent to 40 percent of the face value of the receivable. Their best educated guess is that we will collect about 30 percent.’

Minnie Mize: ‘How about creating a provision for 90 percent of that receivable? It is conservative since, at worst, we’ll collect only 10 percent, and it is easy to defend if we are criticized.’

Max E. Mumm: ‘Why not constitute a 60 percent valuation allowance? The financial analysts will not be happy if we signal that we might have collection problems that could signal lower future earnings numbers. If they feel we do not manage our receivables well, their opinion might lead the banks to raise our cost of capital at the worst time. Let’s work hard on making sure we do collect those 40 percent of that receivable instead of giving up so easily.’

3. Contingent liabilities Eric Faithful: ‘We are also involved in a lawsuit brought against us by Fairprice for patent infringement. They are asking for damages of 200,000 CU. I really see no merit in the suit and we will definitely not settle out of court. I don’t know which way the judge will go. I estimate we have a fifty-fifty chance of losing the case. I would suggest recording a liability for half the amount they are seeking.’

Minnie Mize: ‘Absolutely not. Let’s plan for the worst. What happens if our lawyers blow it? We should provide for the worst case: the full amount. We can reverse the accrual later if our lawyers get us off the hook.

’Max E. Mumm: ‘I think that this is another unneeded accrual. The more you accrue, the less earnings you report. Let’s face it, this is an era of global capital markets. You may not like it, but the view that the analysts have about the company can make or break us. In any case the amount of damages Fairprice is seeking is ridiculously high. In a lawsuit you know that you always ask for five if you want to get one. If we make any provision, we would be admitting that we would be willing to pay that amount. So, I don’t see any need to make any accrual here at this time.’

4. Revenue recognition Celia Vee (VP-Sales): ‘We may have a problem with determining the exact X1 sales revenue. We shipped a truckload of mini-ovens to Pricelead’s warehouse on 28 December. I understand our bookkeeper did not have time to record that invoice until 2

January X2, and I am not sure whether the truck got to their warehouse before that date. We are talking here about an invoice for 500,000 CU; it is no small change. The question is whether to record the sale in X1 or postpone its recognition into X2.’

Max E. Mumm: ‘Since we shipped the goods in December X1, it seems logical to consider it as an X1 sale.’

Minnie Mize: ‘But, wait a minute, the invoice was recorded and mailed in X2 and the goods may have been delivered in X2. The preliminary income figures I received show that the operating income for X1 will be great. Wouldn’t it be better to shift the revenue into X2? Why make X1 even better? In addition, it would be good for the sales force to know they are starting the year X2 with a little plus, don’t you think Celia? Competition is getting harder every day and we all know they have an uphill battle in front of them. Let’s give them a push and record that sale in X2.’

Eric Faithful: ‘Sorry to rain on your parade, but I think Celia forgot to tell you that our shipments are always made FOB Shipping Point, i.e., when the goods leave our warehouse they no longer are our responsibility.’

5. Accrued warranty expense Eric Faithful: ‘Because of our quality control systems, we have relatively low warranty claims. However, we still need to record a liability for our potential warranty claims. Ramon Psikotic, in the Sales department, has estimated that given the sales volume in X1, the warranty provision expense for X1 should be about 100,000 CU.’

Minnie Mize: ‘Yes, but Ramon Psikotic based his calculations on the actual cost of warranty service in X0. The repair department thinks that the cost of servicing our products under warranty is going to increase in the years to come. I believe the total amount of the provision for warranty should be increased to 120,000 CU. We can always adjust the figure downwards later if the real figures end up being less than anticipated.’

Max E. Mumm: ‘Personally, I’ve reviewed Ramon’s calculations and I think he was pessimistic. My opinion is that the accrual for warranty costs should only be 80,000 CU. That’s the number I would go with.’

6. Deferred revenue Eric Faithful: ‘On 1 November, we received a 300,000 CU cash payment for the rent on the warehouse that we leased to Ready-Sol, our European distributor. This represents the rent for three months, i.e., through the end of January X2. We recorded the full payment as rent revenue in the year X1.’

Max E. Mumm: ‘I agree. Since the cash is in, it ought to be recorded as revenue in X1.’

Minnie Mize: ‘Sorry, Max, I don’t agree! One month of that rent relates to January and therefore only two-thirds of the rent payment should be recognized as revenue for X1.’

7. Deferred expenses Eric Faithful: ‘On 1 September, we paid 90,000 CU for our annual liability insurance premium. We recorded the payment as insurance expense (external expense). The period of coverage extends from 1 September X1, to 31 August X2.’

Minnie Mize: ‘What matters is when the payment took place. Keep it fully in X1 expenses.’

Max E. Mumm: ‘Wait a minute, here! Since we had no liability claim in X1, the period during which we will receive the benefits from that premium can only be for X2. It would seem more logical to recognize the expense as belonging to X2.’

Required

1- What are the bases for the arguments of each of the three protagonists? What relevant principle(s) support or infirm their position?

2- Prepare the three sets of financial statements (balance sheet as of 31 December X1, plus income statement for year X1) reflecting strictly the points of view of each of the three protagonists on the seven points evoked during the meeting (assume for this question that each protagonist is legitimate in his or her position).

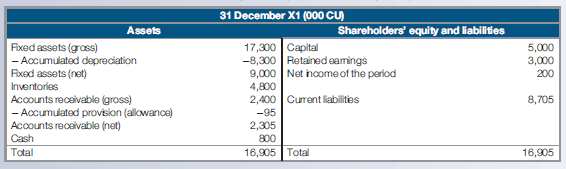

3- Prepare three sets of financial statements (one per protagonist) as of 31 December X1 (balance sheet and income statement) that reflect the correct application of the accounting principles described in the chapter while respecting the position of the person to the largest extent (for example, nothing in the chapter indicates that one asset life expectancy is more appropriate than another, for each case you will use the depreciable life horizon preferred by each individual). Arguments advanced, and positions taken, should be backed-up with references to the relevant accounting principles whenever possible. Exhibits 1 and 2 present the preliminary balance sheet and income statement established by the accountant Exhibit 1 Preliminary balance sheet before yearend adjustments (horizontal, increasing format)

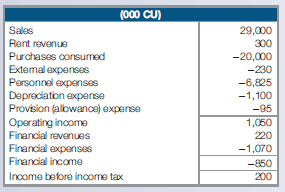

Exhibit 2 Preliminary income statement for X1 before year-end adjustments (format by nature)

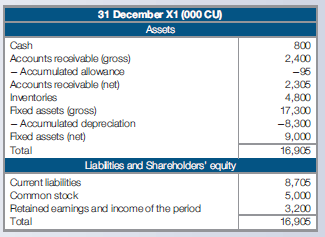

Exhibit 3 Preliminary balance sheet before year-end adjustments (vertical, decreasing format)

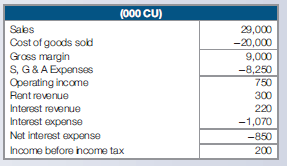

Exhibit 4 Preliminary income statement for X1 before year-end adjustments (format by function)

before any of the seven year-end adjusting entries. Exhibits 3 and 4 present the financial statements using a different format (see this concept in Chapters 2 and 5): vertical, decreasing for the balance sheet and by function for the income statement. Use either Exhibits 1 and 2 or Exhibits 3 and 4 in your answers to the questions above.

=> Calculations should ignore the impact of both income tax and value added tax.

=> The only adjustments that need to be made to the balance sheet and income statement are those relating to the seven issues that were discussed above.

Contingent liabilitiesA contingent liability is an obligation of business related to an uncertain future event. The business must record it in its financial statements if the amount can be reliably estimated and it is probable that amount will be paid by business as a... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Financial Accounting and Reporting a Global Perspective

ISBN: 978-1408076866

4th edition

Authors: Michel Lebas, Herve Stolowy, Yuan Ding