Question: The comparative balance sheets and an income statement for Raceway Corporation follow: Income Statement For the Year Ended December 31, 2014 Sales ........... $480,000 Cost

The comparative balance sheets and an income statement for Raceway Corporation follow:

Income Statement

For the Year Ended December 31, 2014

Sales ........... $480,000

Cost of goods sold ...... (264,000)

Gross profit ........ 216,000

Operating expenses

Depreciation expense .... (11,400)

Rent expense ......... (7,000)

Salaries expense ...... (95,200)

Other operating expenses ... (76,000)

Net income ........ $ 26,400

Other Information

1. Purchased land for $66,000.

2. Purchased new equipment for $62,000.

3. Sold old equipment that cost $66,000 with accumulated depreciation of $56,000 for $10,000 cash.

4. Issued common stock for $30,000.

Required

Prepare the statement of cash flows for 2014 using the indirect method.

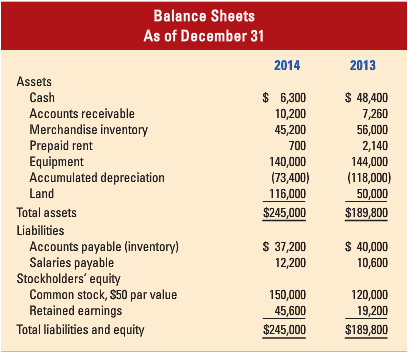

Balance Sheets As of December 31 2014 2013 Assets $ 6,300 10,200 45,200 $ 48,400 7,260 56,000 2,140 144,000 (118,000) 50,000 Cash Accounts receivable Merchandise inventory Prepaid rent Equipment Accumulated depreciation Land 700 140,000 (73,400) 116,000 Total assets $245,000 $189,800 Liabilities $ 37,200 12,200 $ 40,000 Accounts payable (inventory) Salaries payable Stockholders' equity Common stock, $50 par value Retained earnings Total liabilities and equity 10,600 120,000 19,200 $189,800 150,000 45,600 $245,000

Step by Step Solution

3.47 Rating (186 Votes )

There are 3 Steps involved in it

Assets Cash Account Receivable Merchandise Inventory Prepaid Rent Equipment Accumulated Depreciation ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

264-B-M-A-S-C-F (2017).xlsx

300 KBs Excel File