Question: The comparative balance sheets for Strackman Lux Company as of December 31 are presented below. Additional information:1. Operating expenses include depreciation expense of $42,000 and

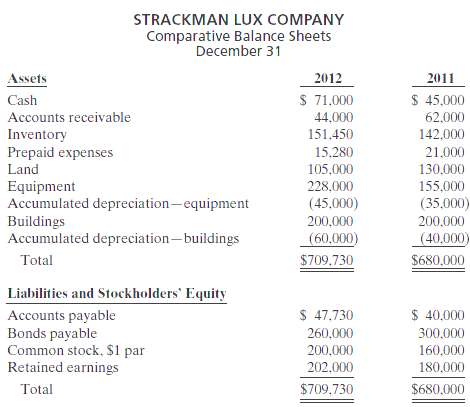

The comparative balance sheets for Strackman Lux Company as of December 31 are presented below.

Additional information:1. Operating expenses include depreciation expense of $42,000 and charges from prepaid expenses of $5,720.2. Land was sold for cash at book value.3. Cash dividends of $15,000 were paid.4. Net income for 2012 was $37,000.5. Equipment was purchased for $95,000 cash. In addition, equipment costing $22,000 with a book value of $10,000 was sold for $6,000 cash.6. Bonds were converted at face value by issuing 40,000 shares of $1 par value common stock.InstructionsPrepare a statement of cash flows for the year ended December 31, 2012, using the indirectmethod.

STRACKMAN LUX COMPANY Comparative Balance Sheets December 31 Assets 2012 S 71,000 44,000 151,450 2011 $ 45,000 Cash Accounts receivable 62.000 Inventory Prepaid expenses Land 142,000 15,280 21.000 105,000 130,000 Equipment Accumulated depreciation-equipment Buildings Accumulated depreciation-buildings 228.000 155,000 (35.000) (45,000) 200,000 200.000 (60,000) (40,000) Total $709.730 $680,000 Liabilities and Stockholders' Equity $ 47,730 260,000 200,000 202.000 $ 40,000 Accounts payable Bonds payable Common stock, $1 par Retained earnings 300,000 160,000 180,000 $709.730 $680,000 Total

Step by Step Solution

3.34 Rating (172 Votes )

There are 3 Steps involved in it

STRACKMAN LUX COMPANY Statement of Cash Flows For the Year Ended December 31 2012 Cash flows ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

54-B-M-A-S-C-F (90).docx

120 KBs Word File