Question: The fixed asset schedule for BCS Manufacturing at December 31, 2011, follows. Buildings are depreciated over thirty years. Factory equipment is depreciated over eight years,

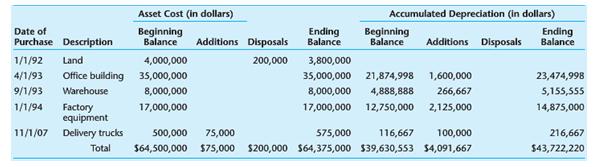

The fixed asset schedule for BCS Manufacturing at December 31, 2011, follows.

Buildings are depreciated over thirty years. Factory equipment is depreciated over eight years, and trucks are depreciated for five years. The company uses straight-line depreciation with no salvage value and calculates monthly depreciation. The new delivery truck was purchased on November 1, 2011. On March 1, 2011, the land was sold for $8,000,000. The client recognized a gain of $7,800,000 on the sale of the land. You have been assigned to audit this schedule at year-end.

a. What is the balance for fixed assets shown on the balance sheet prepared by the client? In other words, what is the balance for which you are gathering evidence to support or correct?

b. Describe the audit procedures necessary to determine whether the ending balances are correct.

c. Perform the review needed to arrive at a decision regarding the balances. Do you think the client’s calculations are accurate?

d. Evaluate the gain or loss recognized by the client for the asset disposals.

e. Propose the adjusting entry needed to correct the accounts.

f. What balance will be reported on the balance sheet if the proposed audit adjustments are recorded?

Asset Cost (in dollars) Accumulated Depreciation (in dollars) Date of Beginning Balance Ending Balance Beginning Balance Ending Balance Purchase Description Additions Disposals Additions Disposals 1/1/92 Land 4,000,000 200,000 3,800,000 4/1/93 Office building 35,000,000 35,000,000 21,874,998 1,600,000 23,474,998 9/1/93 Warehouse 8,000,000 ,000,000 4,888,888 266,667 5,155,555 Factory equipment 1/1/94 17,000,000 17,000,000 12,750,000 2,125,000 14,875,000 11/1/07 Delivery trucks 500,000 75,000 575,000 116,667 100,000 216,667 Total $64,500,000 $75,000 $200,000 $64,375,000 $39,630,553 $4,091,667 $43,722,220

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

a 64375000 fixed assets 43722220 accumulated depreciation 20652780 net assets b Describe the audit procedures necessary to determine whether the endin... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

386-B-A-A-A-N (3609).docx

120 KBs Word File