Question: The following annual data are available for a stock market index: The following annual data are available for a stock market index: The 2013 values

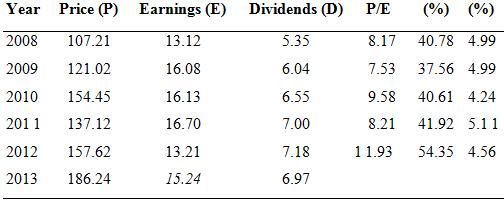

The following annual data are available for a stock market index:

The following annual data are available for a stock market index:

The 2013 values in italics are estimates.

a. Calculate the 2013 values for those columns left blank.

b. On the assumption that g = 0.095, calculate k for 2013 using the formula k = (D/P) +g and show that k = 0.132425.

c. Using the 2013 values, show that P/E = 12.22.

d. Assuming a projection that 2014 earnings will be 25 percent greater than the 2013 value, show that projected earnings are expected to be 19.05.

e. Assuming further that the dividend-payout ratio will be 0.40, show that projected dividends for 2014 will be 7.62.

f. Using the projected earnings and dividends for 2014, and the same k and g used in part b, show that the expected P/E for 2014 is 10.69.

g. Using these expected values for 2014, show that the expected price is 203.61.

h. Recalculate the values for 2014 P/E and P, using the same g = 0.095, but with (1) k = 0.14, (2) k = 0.13, and (3) k = 0.12.

Year 2008 2009 2010 2011 2012 2013 Price (P) 107.21 121.02 154.45 137.12 157.62 186.24 Earnings (E) 13.12 16.08 16.13 16.70 13.21 15.24 Dividends (D) 5.35 6.04 6.55 7.00 7.18 6.97 (%) 8.17 40.78 4.99 7.53 37.56 4.99 9.58 40.61 4.24 8.21 41.92 5.11 11.93 54.35 4.56 P/E (%)

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

a PE 186241524 1222 DE 6971524 04573 4573 DP 69718624 00374 374 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

650-B-A-I (7483).docx

120 KBs Word File