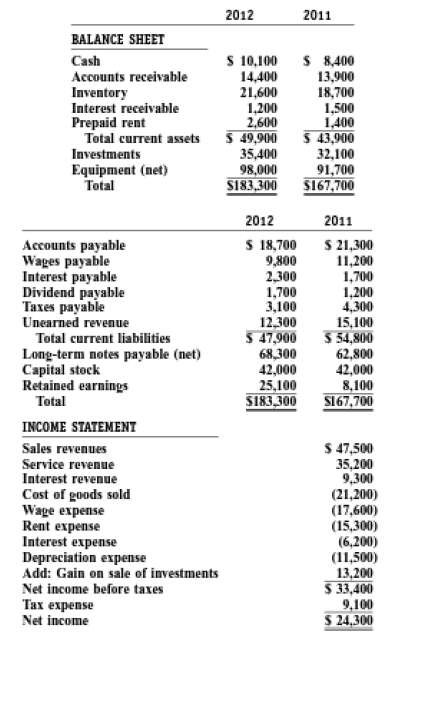

Question: The following balance sheet and income statement data were taken from the records of Harbaugh Auto Supply for the year ended December 31, 2012: The

The following balance sheet and income statement data were taken from the records of Harbaugh Auto Supply for the year ended December 31, 2012:

The company sells goods and provides services. All sales are made on account, and cash is received in advance on services revenues beings recognized after services are performed.Prepare the operating section of the statement of cash flows, and present it under both the direct and indirectmethods.

2012 2011 BALANCE SHEET S 10,100 14,400 21,600 1,200 2,600 5 49,900 35,400 98,000 S183,300 S 8,400 13,900 18,700 Cash Accounts receivable Inventory Interest receivable Prepaid rent Total current assets 1,500 1,400 5 43,900 32,100 Investments Equipment (net) Total 91,700 $167,700 2012 2011 S 18,700 9,800 2,300 1,700 3,100 S 21,300 11,200 1,700 1,200 4,300 15,100 3 54,800 62,800 42,000 8,100 S167,700 Accounts payable Wages payable Interest payable Dividend payable es payabie Unearned revenue 12,300 5 47,900 68,300 42,000 25,100 $183,300 Total current liabilities Long-term notes payable (net) Capital stock Retained earnings Total INCOME STATEMENT $ 47,500 35,200 9,300 (21,200) (17,600) (15,300) (6,200) (11,500) 13,200 S 33,400 9,100 S 24,300 Sales revenues Service revenue Interest revenue Cost of goods sold Wage expense Rent expense Interest expense Depreciation expense Add: Gain on sale of investments Net income before taxes xpense Net income

Step by Step Solution

3.45 Rating (181 Votes )

There are 3 Steps involved in it

Harbaugh Auto Supply Operating Section Statement of Cash Flows Direct Method For the Year Ended Dece... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-M-A-S-C-F (173).docx

120 KBs Word File