Question: The following condensed balance sheet for December 31, 2012, comes from the records of Buzz and Associates: Buzz and Associates is considering the purchase of

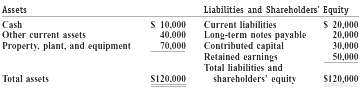

The following condensed balance sheet for December 31, 2012, comes from the records of Buzz and Associates:

Buzz and Associates is considering the purchase of a new piece of equipment for $30,000. The company does not have enough cash to purchase it outright, so it is considering alternative ways of financing. AS management sees it, there are three basic options: (1) issue 3,000 ownership shares for $10 per share, (2) take out a long-term loan (12 percent annual) interest) for $30,000 from the bank, or (3) purchase the equipment on open account (must be paid in full in thirty days). Presently Buzz has 12,000 ownership shares outstanding.Required:a. Compute the present current ratio (current assets/current liabilities), the debt/equity ratio (total liabilities/shareholders' equity), and the book value of Buzz's outstanding ownership shares: (total assets minus total liabilities) divided by number of shares outstanding.b. Compute the current ratio, debt/equity ratio, and book value per share under each of the three financing alternatives, and express your answer in the following format:Financing Alternative Current Ratio Debt/Equity Ratio Book Value per Share1. Share issuance2. Long-term note3. Open accountc. Discuss some of the pros and cons associated with each of the three financing options.d. The chairman of the board of directors stated at a recent board meeting that with $50,000 in Retained Earnings, the company should be able to purchase the $30,000 piece of equipment. Comment on the chairman's statement.

Assets Cash Other current assets Property, plant, and equipment Liabilities and Shareholders' Equity Current liabilities Long-term notes payable Contributed capital Retained earnings Total liabilities and shareholders' equity S 10.000 S 20,000 40.000 70.000 20,000 30,000 51,000 Total assets S120.000 S120,000

Step by Step Solution

3.32 Rating (161 Votes )

There are 3 Steps involved in it

a Current ratio Current assets Current liabilities 10000 40000 20000 250 Debtequity Total liabilities Total stockholders equity 20000 20000 30000 50000 50 Book value Net assets Number of shares outsta... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-A-F-S (531).docx

120 KBs Word File