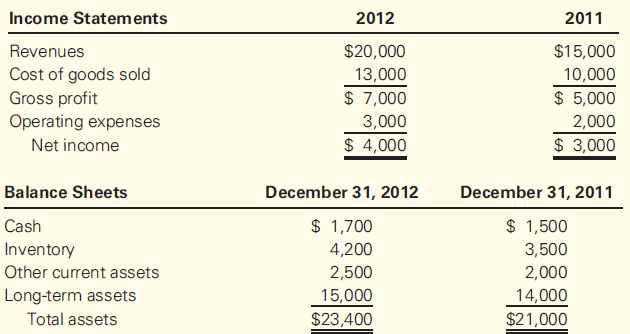

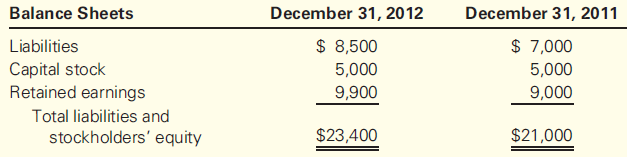

The following highly condensed income statements and balance sheets are available for Budget Stores for a two-year

Question:

The following highly condensed income statements and balance sheets are available for Budget Stores for a two-year period. (All amounts are stated in thousands of dollars.)

Before releasing the 2012 annual report, Budget's controller learns that the inventory of one of the stores (amounting to $600,000) was inadvertently omitted from the count on December 31, 2011. The inventory of the store was correctly included in the December 31, 2012, count.

Required

1. Prepare revised income statements and balance sheets for Budget Stores for each of the two years. Ignore the effect of income taxes.

2. If Budget did not prepare revised statements before releasing the 2012 annual report, what would be the amount of overstatement or understatement of net income for the two-year period? What would be the overstatement or understatement of retained earnings at December 31, 2012, if revised statements were not prepared?

3. Given your answers in part (2), does it matter if Budget bothers to restate the financial statements of the two years to rectify the error? Explain your answer.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Using Financial Accounting Information The Alternative to Debits and Credits

ISBN: 978-1111534912

8th edition

Authors: Gary A. Porter, Curtis L. Norton