Question: The following income statement was reported by battery Builders for the year ending December 31, 2012: Show how battery builders would report earrings per share

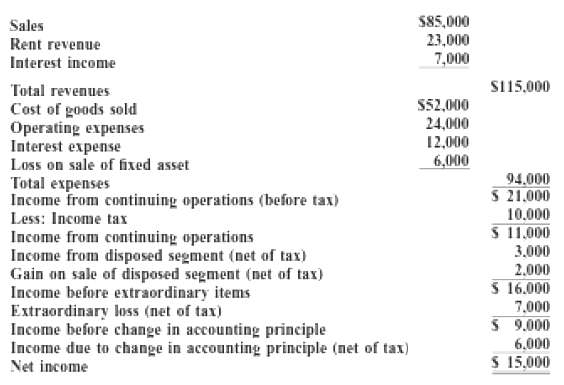

The following income statement was reported by battery Builders for the year ending December 31, 2012:

Show how battery builders would report earrings per share on the face of the income statement, assuming the following:(a) An average of 15,000 shares of common stock was outstanding during 2012.(b) An average of 25,000 shares of common stock was outstanding during 2012.(c) An average of 30,000 shares of common stock was outstanding during 2012.

S85,000 23,000 7,000 Sales Rent revenue Interest income S115.000 Total revenues Cost of goods sold Operating expenses Interest expense Loss on sale of fixed asset 52,000 24,000 12,000 6,000 94.000 5 21.000 Total expenses Income from continuing operations (before tax) Less: Income tax Income from continuing operations Income from disposed segment (net of tax) Gain on sale of disposed segment (net of tax) Income before extraordinary items Extraordinary loss (net of tax) Income before change in accounting principle Income due to change in accounting principle (net of tax) Net income 10.000 S 11.000 3,000 2.000 S 16.000 7,000 S 9.000 6.000 S 15,000

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

a Income from continuing operations 073 Disposal of business segmen... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-M-A-S-C-F (118).docx

120 KBs Word File