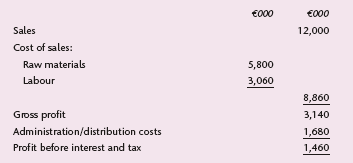

The following information has been extracted from the financial statements of Rowett: Statement of profit or loss

Question:

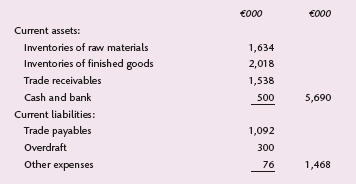

The following information has been extracted from the financial statements of Rowett:

Statement of profit or loss extracts

Financial position statements extracts

Powell, a factoring company, has offered to take over Rowett’s debt administration and credit control on a non-recourse basis for an annual fee of 2 per cent of sales. This would save Rowett €160,000 per year in administration costs and reduce bad debts from 0.5 per cent of sales to nil. Powell would reduce trade receivables days to 40 days and would advance 75 per cent of invoiced debts at an interest rate of 10 per cent.

Rowett finances working capital from an overdraft at 8 per cent.

(a) Calculate the length of Rowett’s cash conversion cycle and discuss its significance to the company.

(b) Discuss ways in which Rowett could improve the management of its receivables.

(c) Using the information given, assess whether Rowett should accept the factoring service offered by Powell. What use should the company make of any finance provided by the factor?

Cash Conversion CycleCash conversion cycle measures the total time a business takes to convert its cash on hand to produce, pay its suppliers, sell to its customers and collect cash from its customers. The process starts with purchasing of raw materials from suppliers,... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Corporate Finance Principles and Practice

ISBN: 978-1292103037

7th edition

Authors: Denzil Watson, Antony Head