Question: The following information was taken from the inventory footnote contained in the 2009 annual report of Deere & Company, the agricultural equipment manufacturer. Most inventories

The following information was taken from the inventory footnote contained in the 2009 annual report of Deere & Company, the agricultural equipment manufacturer.

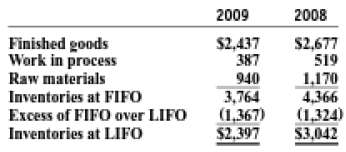

Most inventories owned by Deere & Company and its U.S. equipment subsidiaries are valued at cost, on the last-in. first-out (LIFO) basis. Remaining inventories are generally valued at the lower of cost, on the first-in, first-out (FIFO) basis, or market. The value of gross inventories on the LIFO basis represented 59 percent and 64 percent of worldwide gross inventories at FIFO value on October 31, 2009 and 2008, respectively.REQUIRED:a. Why would a potential investor or creditor who is considering investing in Deere be interested in the difference between LIFO and FIFO inventory values?b. Explain why reducing certain inventory quantities, valued under LIFO, would increase net income and why an investor would be interested in such a disclosure.c. Deere's effective tax rate is 34 percent. Approximately how much more income tax would Deere have paid if at the end of 2009 it switched to FIFO for all of its inventory?d. Explain why Deere & Company might resist adopting IFRS.

2009 2008 Finished goods Work in process $2,437 387 940 3,764 (1,367) $2,397 S2,677 519 1.170 4,366 (1,324) S3,042 Raw materials Inventories at FIFO Excess of FIFO over LIFO Inventories at LIFO

Step by Step Solution

3.26 Rating (181 Votes )

There are 3 Steps involved in it

a The choice of LIFO or FIFO will affect the amounts a company reports both in its balance sheet for inventory and in its income statement for cost of ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-A-I-A (738).docx

120 KBs Word File