Question: The following selected financial information was obtained from the 2012 financial reports of Robotranics, Inc. and Technology, Limited: Assume that total assets, total liabilities, and

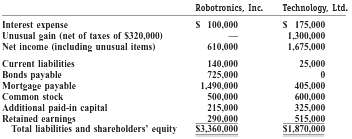

The following selected financial information was obtained from the 2012 financial reports of Robotranics, Inc. and Technology, Limited:

Assume that total assets, total liabilities, and total shareholders?? equity were constant through-out 2012.Required:a. Assume that you are considering purchasing the common stock of one of these companies. Which company has a higher return on equity? Would your conclusion be different if the impact of the unusual item had not been included in net income? Should unusual items be considered? Why or why not?b. Which company uses leverage more effectively? Does your answer change in you do not consider the impact of the unusual item on netincome?

Robotronics, Inc. Technology. Ltd. Interest expense Unusual gain (net of taxes of S320,000) Net income (including unusual items) S 100,000 S 175,000 1,300,000 1,675,000 610.000 Current liabilities Bonds payable Mortgage payable Common stock Additional paid-in capital Retained earnings Total liabilities and sharebolders' equity 25,000 140.000 725,000 1.490,000 500,000 215,000 405.000 600,000 325,000 290.000 515,000 S1.870,000 S3,3

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

a Return on Equity Net Income Average Stockholders Equity Robotronics 610000 1005000 1005000 2 607 Technology 1675000 1440000 1440000 2 1163 Based on ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-A-F-S (577).docx

120 KBs Word File