Question: The following selected information is avail-able for Smith & Co. Ltd., for the year ended 31 December 31 20X8: Other information: 1. Equipment with an

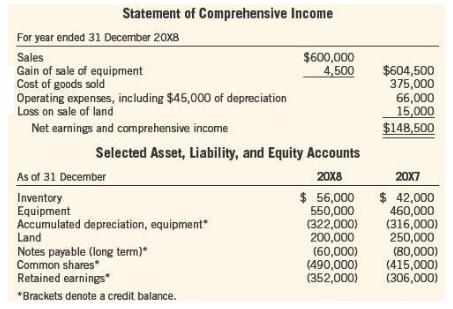

The following selected information is avail-able for Smith & Co. Ltd., for the year ended 31 December 31 20X8:

Other information:

1. Equipment with an original cost of $ 50,000 was sold for cash.

2. Other equipment was bought for cash.

3. There is no income tax expense.

4. Cash dividends were paid during the year as well as a $ 25,000 stock dividend that reduced retained earnings and increased common shares.

Required:

Present, in good form, the operating, investing, and financing section of the SCF for the year ended 31 December 20X8 as far as possible. Also list the non- cash transactions that would be separately disclosed.

Statement of Comprehensive Income For year ended 31 December 20X8 $600,000 4,500 Sales Gain of sale of equipment Cost of goods sold Operating expenses, including $45,000 of depreciation Loss on sale of land $604,500 375,000 66,000 15,000 $148,500 Net earnings and comprehensive income Selected Asset, Liability, and Equity Accounts As of 31 December 20X8 20X7 Inventory Equipment Accumulated depreciation, equipment Land $ 56,000 550,000 (322,000) 200,000 (60,000) (490,000) (352,000) $ 42,000 460,000 (316,000) 250,000 (80,000) (415,000) (306,000) Notes payable (long term)" Common shares Retained earnings" *Brackets denote a credit balance.

Step by Step Solution

3.41 Rating (179 Votes )

There are 3 Steps involved in it

Partial Statement of Cash Flows For the year ended 31 December 20x8 Operations Net earnings 1... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

396-B-M-A-S-C-F (2920).docx

120 KBs Word File