Question: The following selected transactions were taken from the records of Burrito Company for the year ending December 31, 2010: Mar. 13. Wrote off account of

The following selected transactions were taken from the records of Burrito Company for the year ending December 31, 2010:

Mar. 13. Wrote off account of B. Hall, $4,200.

Apr. 19. Received $3,000 as partial payment on the $7,500 account of M. Rainey. Wrote off the remaining balance as uncollectible.

July 9. Received the $4,200 from B. Hall, which had been written off on March 13. Reinstated the account and recorded the cash receipt.

Nov. 23. Wrote off the following accounts as uncollectible (record as one journal entry):

Rai Quinn$1,200

P. Newman 750

Ned Berrry 2,900

Mary Adams 1,675

Nichole Chapin 480

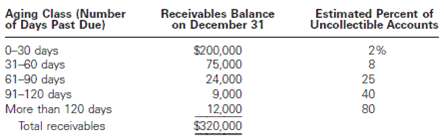

Dec. 31. The company prepared the following aging schedule for its accounts receivable:

a. Journalize the transactions for 2010 under the direct write-off method.b. Journalize the transactions for 2010 under the allowance method, assuming that the allowance account had a beginning balance of $12,000 on January 1, 2010, and the company uses the analysis of receivables method.c. How much higher (lower) would Burrito's 2010 net income have been under the direct write-off method than under the allowance method?

Aging Class (Number Past Due) Receivables Balance on December 31 Estimated Percent of Uncollectible Accounts of Days 0-30 days 31-60 days 2% S200,000 24,000 25 40 91-120 days More than 120 days Total receivables 9,000 12,000 $320,000 80

Step by Step Solution

3.42 Rating (174 Votes )

There are 3 Steps involved in it

a Journalizing the Transaction for 2010 under the Direct WriteOff Method b Journa... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

46-B-A-C-R (124).docx

120 KBs Word File