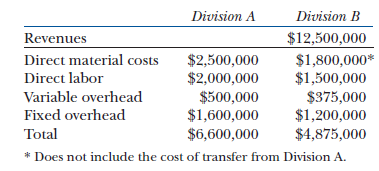

The following table presents the performance of two divisionsDivision A and Division Bof a company. Division A

Question:

The following table presents the performance of two divisions—Division A and Division B—of a company. Division A supplies an intermediate product to Division B. Although there is an outside market for Division A’s product, it does not sell its product to the outside market.

Required:

a. Assume that the transfer price is 110% of Division A’s full cost. Prepare an income statement for each division.

b. Assume that the transfer price is 120% of Division A’s variable cost. Prepare an income statement for each division.

c. Assume that the transfer price is the market price. If Division A could sell its entire output in the intermediate market, it would realize revenues of $8,000,000. Prepare an income statement for each division.

d. What conclusions do you draw from comparing your answers? Under what conditions would you recommend the transfer-pricing schemes in requirements in parts (a), (b), and (c) above

Step by Step Answer:

Managerial accounting

ISBN: 978-0471467854

1st edition

Authors: ramji balakrishnan, k. s i varamakrishnan, Geoffrey b. sprin