The following transactions and events affected a Special Revenue Fund of Stem Independent School District during 20X4.

Question:

The following transactions and events affected a Special Revenue Fund of Stem Independent School District during 20X4.

1. The chief accountant discovered that (a) the $20,000 proceeds of a sale of used educational equipment in 20X3 had been recorded as 20X4 revenues when received in early 20X4, and (b) $150,000 of property taxes receivable were not available at the end of 20X3 but were reported as revenues in 20X3.

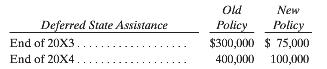

2. Because of a change in the timing of the payments of the state minimum education program assistance grants to school districts, the related revenue recognition policy was changed. Substantial amounts of the state payments for the prior fiscal year were reported as deferred revenue at year end under the old policy, but most will now be considered available revenue. The comparative Deferred State Assistance account balances at the end of the current year and prior year under the old and new policies were determined to be:

3. The auditor discovered the following errors:

a. Special instruction fees of $8,000 paid for the hearing-impaired education program, properly chargeable to the 20X4 Education—Hearing-Impaired account in the General Fund, were charged to that account in this Special Revenue Fund.

b. $130,000 of federal grant revenues were earned by incurring qualifying expenditures during 20X3, but no grant cash had been received and no revenues were recorded in 20X3. Furthermore, the federal grantor agency has not been billed for this payment.

c. A transfer from the General Fund during 20X4, $85,000, was credited to the Revenues—Other account in this Special Revenue Fund.

d. Interest revenue earned and received during 20X4, $15,000, was improperly recorded as Revenues—Other, whereas a separate Revenues—Interest account is maintained.

e. A 20X4 payment in lieu of taxes by the federal government was erroneously credited to the Education—General and Administrative expenditures account, $50,000.

4. The following adjusting entries were determined to be necessary at the end of 20X4:

a. State special education grants received during 20X4 and recorded as 20X4 revenues, $800,000, were only 75% earned by incurring qualifying expenditures during 20X4.

b. The Stem Independent School District was notified that the state had collected $300,000 of sales taxes for its benefit and would remit them early in 20X5.

Required

Prepare the journal entries to record these error corrections, changes in accounting principles, and adjustments in the General Ledger accounts only of the Special Revenue Fund of Stem Independent School District.

Step by Step Answer:

Governmental and Nonprofit Accounting

ISBN: 978-0132751261

10th edition

Authors: Robert Freeman, Craig Shoulders, Gregory Allison, Robert Smi