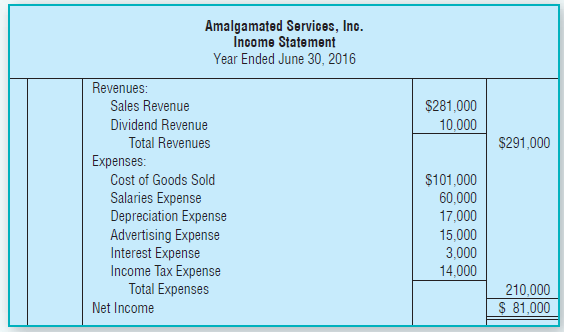

Question: The income statement and additional data of Amalgamated Services, Inc., follow: Additional data follows: a. Acquisition of fixed assets totaled $115,000. Of this amount, $85,000

The income statement and additional data of Amalgamated Services, Inc., follow:

Additional data follows:

a. Acquisition of fixed assets totaled $115,000. Of this amount, $85,000 was paid in cash and a $30,000 note payable was signed for the remainder.

b. Proceeds from the sale of land totaled $21,000. No gain or loss was recognized on the sale.

c. Proceeds from issuance of common stock total $34,000.

d. Payment of long-term note payable was $17,000.

e. Payment of dividends was $11,000.

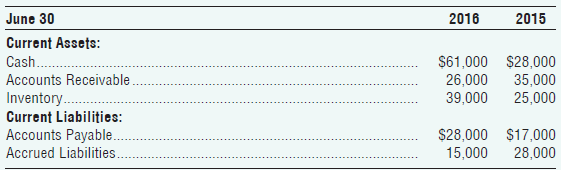

f. Data from the comparative balance sheet follow:

Requirements

Requirements

1. Prepare Amalgamated Services’ statement of cash flows for the year ended June 30, 2016, using the indirect method.

2. Calculate Amalgamated Services free cash flow for the year ended June 30, 2016.

3. Evaluate Amalgamated Services’ cash flows for the year. In your evaluation, mention all three categories of cash flows as well as free cash flow and give the reason for your evaluation?

Amalgamated Services, Inc. Income Statement Year Ended June 30, 2016 Revenues: Sales Revenue $281,000 10,000 Dividend Revenue Total Revenues $291,000 Expenses: $101,000 60,000 Cost of Goods Sold Salaries Expense Depreciation Expense 17,000 Advertising Expense Interest Expense Income Tax Expense Total Expenses 15,000 3,000 14,000 210,000 $ 81,000 Net Income June 30 2016 2015 Current Assets: $61,000 $28,000 26,000 Cash.. Accounts Receivable Inventory.. Current Liabilities: Accounts Payable. Accrued Liabilities. 35,000 39,000 25,000 $28,000 $17,000 28,000 15,000

Step by Step Solution

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Req 1 Amalgamated Services Inc Statement of Cash Flows Year Ended June 30 2016 Cash flows from opera... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (3 attachments)

1350_60b9f89aedb24_607908.pdf

180 KBs PDF File

1350-B-M-A-I(3586).xlsx

300 KBs Excel File

1350_60b9f89aedb24_607908.docx

120 KBs Word File