Question: The information below is from the 2008 financial statements and accompanying notes of The Scotts Company, a major manufacturer of lawn-care products. THE SCOTTS COMPANYNotes

The information below is from the 2008 financial statements and accompanying notes of The Scotts Company, a major manufacturer of lawn-care products.

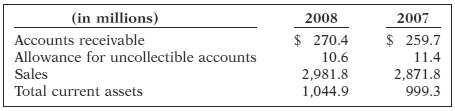

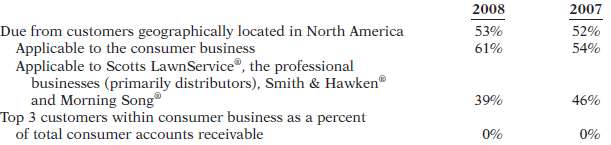

THE SCOTTS COMPANYNotes to the Financial StatementsNote 19. Concentrations of Credit RiskFinancial instruments which potentially subject the Company to concentration of credit risk consist principally of trade accounts receivable. The Company sells its consumer products to a wide variety of retailers, including mass merchandisers, home centers, independent hardware stores, nurseries, garden outlets, warehouse clubs, food and drug stores and local and regional chains. Professional products are sold to commercial nurseries, greenhouses, landscape services and growers of specialty agriculture crops. Concentrations of accounts receivable at September 30, net of accounts receivable pledged under the terms of the New MARP Agreement whereby the purchaser has assumed the risk associated with the debtor's financial inability to pay ($146.6 million and $149.5 million for 2008 and 2007, respectively), were as follows:

The remainder of the Company's accounts receivable at September 30, 2008 and 2007, were generated from customers located outside of North America, primary retailers, distributors, nurseries and growers in Europe. No concentrations of customers of individual customers within this group account for more than 10% of the Company's accounts receivable at either balance sheet date.The Company's three largest customers are reported within the Global Consumer segment, and are the only customers that individually represent more than 10% of reported consolidated net sales for each of the last three fiscal years. These three customers accounted for the following percentages of consolidated net sales for the fiscal years ended September 30:

InstructionsAnswer each of the following questions.(a) Calculate the receivables turnover ratio and average collection period for 2008 for the company.(b) Is accounts receivable a material component of the company's total 2008 current assets?(c) Scotts sells seasonal products. How might this affect the accuracy of your answer to part (a)?(d) Evaluate the credit risk of Scotts' 2008 concentrated receivables.(e) Comment on the informational value of Scotts' Note 19 on concentrations of credit risk.

(in millions) 2007 259.7 11.4 2,871.8 999.3 2008 Accounts receivable Allowance for uncollectible accounts Sales Total current assets 270.4 10.6 2,981.8 1,044.9

Step by Step Solution

3.47 Rating (173 Votes )

There are 3 Steps involved in it

a b Accounts receivable represent 249 2704 10610449 of the companys current assets This is a materia... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

48-B-A-C-R (290).docx

120 KBs Word File