The Mendoza Company discussed in the chapter is now considering replacing a piece of equipment that the

Question:

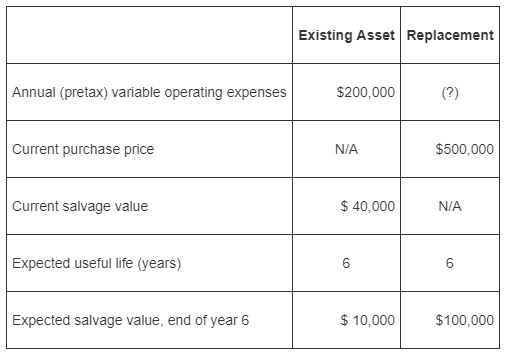

The Mendoza Company discussed in the chapter is now considering replacing a piece of equipment that the company uses to monitor the integrity of metal pipes used for deep-sea drilling purposes. The company’s pretax WACC is estimated as 12 percent. The following data are pertinent to the question you’ve been asked to analyze:

Required

1. What is the maximum amount of annual variable operating expenses, pretax, that would make this an attractive investment from a present-value standpoint?

2. Assume now that the company expects, over the coming six years, to be subject to a combined income-tax rate of 40 percent, including any gain/loss realized on the sale of the existing equipment. Assume that the current book value of the existing asset is $50,000 and that the after-tax WACC for Mendoza is 10 percent. Finally, assume that the company will use SL depreciation, with no salvage value, for income-tax purposes. In this situation, what is the maximum amount of variable operating costs that can be incurred in order to make the proposed purchase attractive in a present-value sense?

3. What strategic considerations might affect the decision whether to invest in this newequipment?

Step by Step Answer:

Cost management a strategic approach

ISBN: 978-0073526942

5th edition

Authors: Edward J. Blocher, David E. Stout, Gary Cokins