Question: The purchase schedule for Lumbermans and Associates is as follows: The inventory balance as of the beginning of the year was $15,000 (15,000 units @

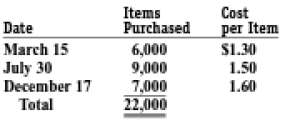

The purchase schedule for Lumbermans and Associates is as follows:

The inventory balance as of the beginning of the year was $15,000 (15,000 units @ $1), and an inventory count at year-end indicated that 11,000 items were on hand. Sales and expenses (excluding cost of goods sold) totaled $55, 000 and $15,000, respectively. The federal income tax is 30 percent of taxable incomeREQUIRED:a. Prepare three income statements, one under each of the assumptions: FIFO, average, and LIFO.b. How many tax dollars would be saved by using LIFO instead of FIFO?c. Assume that the market value of an inventory item dropped to $1.35 as of year-end. Apply the lower-of-cost-or-market rule, and provide the appropriate journal entry (if necessary) under the FIFO, averaging, and LIFO assumptions.d. Repeat (a) above assuming that the costs per item were as follows:Beginning inventory....$1.60March 15...........1.40July 30............1.30December 17........1.20Which of the three assumptions gives rise to the highest net income and ending inventory amounts now?Why?

Items Purchased 6,000 9,000 Cost per Item S1.30 1.50 Date March 15 July 30 December 17 Total 7,000 22,000 1.60

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

a Cost of Goods Available for Sale Cost of Goods in Beginning Inventory Cost of Goods Purchased 15000 units x 1 6000 units x 130 9000 units x 150 7000 units x 160 47500 Number of Units Available for S... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-A-I-A (729).docx

120 KBs Word File