The statements of financial position of Parkway plc for 20X7 and 20X8 are given below, together with

Question:

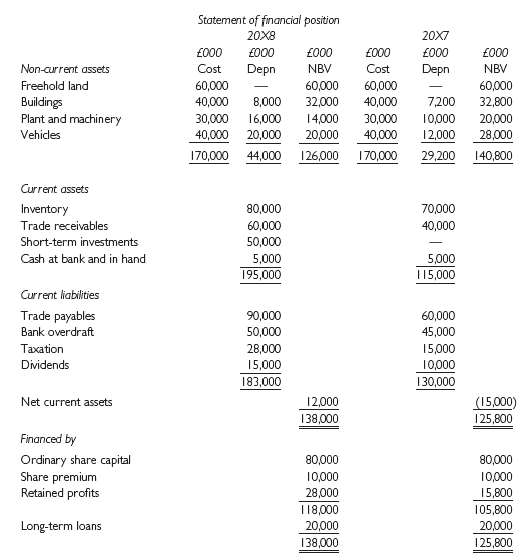

The statements of financial position of Parkway plc for 20X7 and 20X8 are given below, together with the income statement for the year ended 30 June 20X8.

Statement of comprehensive income of Parkway plc

for the year ended 30 June 20X8

£000

Sales ............ 738,000

Cost of sales ....... 620,000

Gross profit ......... 118,000

Notes

1 The freehold land and buildings were purchased on 1 July 20X0. The company policy is to depreciate buildings over 50 years and to provide no depreciation on land.

2 Depreciation on plant and machinery and motor vehicles is provided at the rate of 20% per annum on a straight-line basis.

3 Depreciation on buildings and plant and equipment has been included in administration expenses, while that on motor vehicles is included in distribution expenses.

4 The directors of Parkway plc have provided you with the following information relating to price rises:

Required:

(a) Making and stating any assumptions that are necessary, and giving reasons for those assumptions, calculate the monetary working capital adjustment for Parkway plc.

(b) Critically evaluate the usefulness of the monetary working capitaladjustment.

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Financial Accounting and Reporting

ISBN: 978-0273744443

14th Edition

Authors: Barry Elliott, Jamie Elliott