Question: The Surplus Value Company had $10 million (face value) of convertible bonds outstanding in 2001. Each bond has the following features: (a) What is the

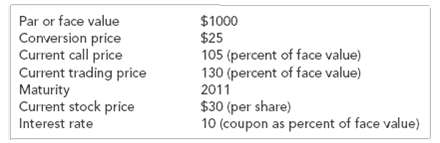

The Surplus Value Company had $10 million (face value) of convertible bonds outstanding in 2001. Each bond has the following features:

(a) What is the bond?s conversion value?

(b) Can you explain why the bond is selling above conversion value?

(c) Should Surplus call? What will happen if it does so?

Par or face value Conversion price Current call price Current trading price Maturity Current stock price $1000 $25 105 (percent of face value) 130 (percent of face value) 2011 $30 (per share) 10 (coupon as percent of face value) Interest rate

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

a With a 1000 face value for the bonds a bondholder can convert one bond into 100025 40 shares ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-O (62).docx

120 KBs Word File