The unsecured creditors of Dawn Corporation filed a petition under Chapter 7 of the bankruptcy act on

Question:

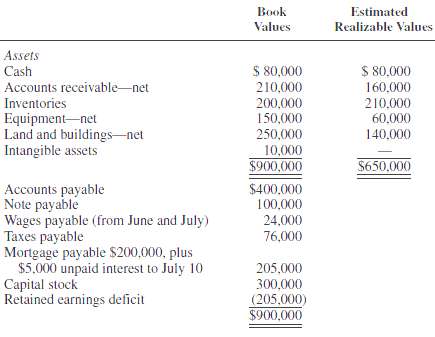

The unsecured creditors of Dawn Corporation filed a petition under Chapter 7 of the bankruptcy act on July 1, 2011, to force Dawn into bankruptcy. The court order for relief was granted on July 10, at which time an interim trustee was appointed to supervise liquidation of the estate. A listing of assets and liabilities of Dawn Corporation as of July 10, 2011, along with estimated realizable values, is as follows:

ADDITIONAL INFORMATION1. Accounts receivable are pledged as security for the note payable.2. No more than $1,000 is owed to any employee.3. Taxes payable is a priority item.4. Inventory items include $50,000 acquired on July 5, 2011; the unpaid invoice is included in accounts payable.5. The mortgage payable and interest are secured by the land and buildings.6. Trustee fees and other costs of liquidating the estate are expected to be $11,000.REQUIRED1. Prepare a statement of affairs for Dawn Corporation on July 10, 2011.2. Develop a schedule showing how available cash will be distributed to each class of claims, assuming that (a) the estimated realizable values are actually received and (b) the trustee and other fees of liquidating the estate are$11,000.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due....

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith