The wireless phone manufacturing division of a consumer electronics company uses activity-based costing. For simplicity, assume that

Question:

The wireless phone manufacturing division of a consumer electronics company uses activity-based costing. For simplicity, assume that its accountants have identified only the following three activities and related cost drivers for indirect production costs:

Activity …………………….. Cost Driver

Materials handling … Direct-materials cost

Engineering … Engineering change notices

Power ……………………. Kilowatt hours

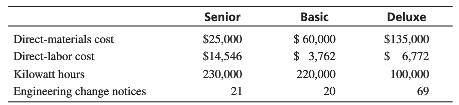

Three types of cell phones are produced: Senior, Basic, and Deluxe. Direct costs and cost-driver activity for each product for a recent month are as follows:

Indirect production costs for the month were as follows:

Materials handling …………….. $ 15,400

Engineering ……………………… 99,000

Power ……………………………. 11,000

Total indirect production cost … $125,400

1. Compute the indirect production costs allocated to each product with the ABC system.

2. Suppose all indirect production costs had been allocated to products in proportion to their direct- labor costs. Compute the indirect production costs allocated to each product.

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta