Question: This problem can be used in conjunction with Problem. Refer to Problem. During June 2010, Mason Resources completed these transactions: a. The business received cash

This problem can be used in conjunction with Problem. Refer to Problem.

During June 2010, Mason Resources completed these transactions:

a. The business received cash of $9,200 and issued common stock.

b. Performed services for a customer and received cash of $6,700.

c. Paid $4,500 on accounts payable.

d. Purchased supplies on account, $600.

e. Collected cash from a customer on account, $700.

f. Consulted on the design of a computer system and billed the customer for services rendered, $2,900.

g. Recorded the following business expenses for the month: (1) paid office rent––$1,100; (2) paid advertising––$1,000.

h. Declared and paid a cash dividend of $1,500.

Requirements

1. Journalize the June transactions of Mason Resources, Inc. Explanations are not required.

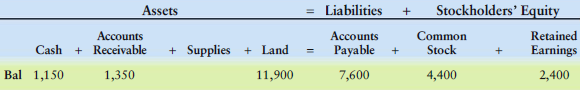

2. Prepare T-Accounts for each account. Insert in each T-account its May 31 balance as given (example: Cash $1,150). Then, post the June transactions to the T-Accounts.

3. Compute the balance in each account.

Stockholders' Equity = Liabilities Assets Common Stock Accounts Payable Retained Accounts Earnings 2,400 Cash + Supplies + Land 11,900 + Receivable Bal 1,150 7,600 1,350 4,400

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Req 1 Journal ACCOUNT TITLES DEBIT CREDIT a Cash 9200 Common Stock 9200 b Cash 6700 Service Revenue ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

196-B-A-T-D (921).docx

120 KBs Word File