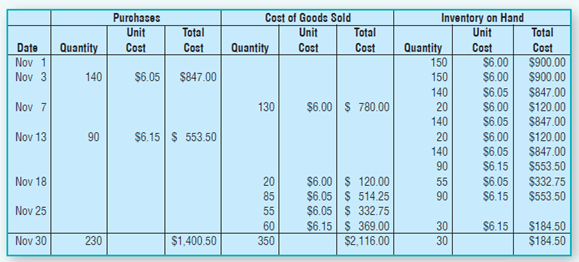

Top Fuel Auto Parts, Inc., had the following FIFO perpetual inventory record for one of its inventory

Question:

Top Fuel Auto Parts, Inc., had the following FIFO perpetual inventory record for one of its inventory items at November 30, the end of the fiscal year.

A physical count of the inventory performed at year-end revealed $172.20 (28 items) of inventory on hand for this item.

Requirements

1. Journalize the adjusting entry for inventory, if any is required.

2. What could have caused the value of the ending inventory based on the physical count to be lower than the amount based on the perpetual inventory record?

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: