Trade Barriers against Unfair Competition: Some countries subsidize some of their industries heavily which leads U.S.

Question:

A: Suppose that initially the domestic demand and supply curves for steel intersect at the same price in the U.S. as in Europe.

(a) Begin by illustrating this in side-by-side graphs.

(b) Next, suppose Europe introduces a subsidy for each ton of steel. Illustrate the impact this has on the price paid by buyers of steel in Europe before any trade with the U.S. emerges.

(c) Suppose the U.S. does not introduce any tariffs on steel to counter the subsidy given in Europe. What will happen to steel prices in the U.S.? Why?

(d) In your U.S. graph, illustrate the change in consumer and producer surplus (and assume for simplicity that there are no income effects in the steel market). Are U.S. steel producers rational when they lobby for steel tariffs in response to European steel subsidies?

(e) What happens to total surplus in the U.S.? On purely efficiency grounds, would you advocate for U.S. tariffs in response to European subsidies on steel?

(f) Without pinpointing areas in the graph, do you think trade increases or reduces the deadweight loss from the subsidy in Europe?

(g) How much of a tariff would the U.S. have to impose in order to eliminate any effect of the European steel subsidies on U.S. markets?

(h) Suppose the steel industry is perfectly competitive in both Europe and the U.S. True or False: The European steel subsidy, if not followed by a U.S. tariff on European steel, would in the long run eliminate the U.S. steel industry while at the same time increasing U.S. overall surplus.

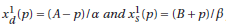

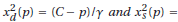

B. Now consider demand and supply functions

Europe and

(D + p) / δ for the U.S. Let α = γ = 0.00006, β = δ = 0.0001, A =C = 800 and B = D = 0.

(a) Calculate the prices and quantities in Europe and the U.S. in the absence of trade. Is there any reason for trade to emerge?

(b) Suppose next that Europe puts a $250 per ton subsidy for steel in place. In the absence of any trade, what happens to the purchase price of a ton of steel? What happens to the price received by sellers?

(c) If there are no trade barriers in place, how much steel will now be exported from Europe to the U.S.? What will be the equilibrium price of steel in the U.S.?

(d) How much of a tariff on steel would the U.S. have to impose to prevent the European steel subsidy from affecting the U.S. market for steel?

(e) What is the deadweight loss in the U.S. of such a tariff (assuming no income effects)?

Step by Step Answer:

Microeconomics An Intuitive Approach with Calculus

ISBN: 978-0538453257

1st edition

Authors: Thomas Nechyba