Question: Use the appropriate factors from Table 6-4 or Table 6-5 to answer the following questions. Required: a. Staley Co.s common stock is expected to have

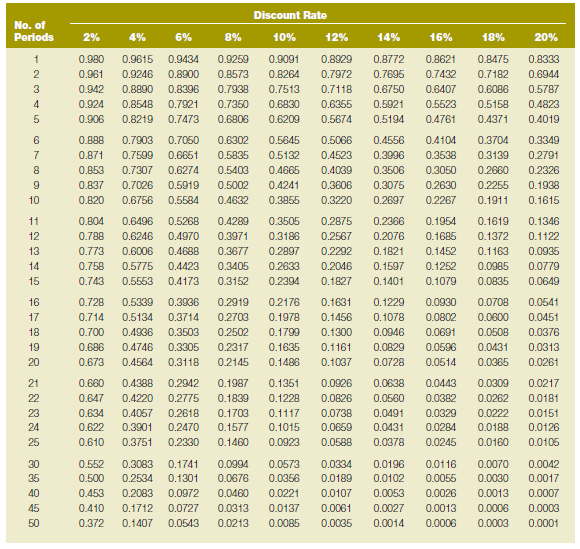

Use the appropriate factors from Table 6-4 or Table 6-5 to answer the following questions.

Required:

a. Staley Co.’s common stock is expected to have a dividend of $6 per share for each of the next 12 years, and it is estimated that the market value per share will be $136 at the end of 12 years. If an investor requires a return on investment of 12%, what is the maximum price the investor would be willing to pay for a share of Staley Co. common stock today?

b. Chapman bought a bond with a face amount of $1,000, a stated interest rate of 6%, and a maturity date 10 years in the future for $964. The bond pays interest on an annual basis. Five years have gone by and the market interest rate is now 8%. What is the market value of the bond today?

c. Laura purchased a U.S. Series EE savings bond for $100, and 10 years later received $259.40 when the bond was redeemed. What average annual return on investment did Laura earn over the 10 years?

Table 6-4

Discount Rate No. of Periods 10% 4% 6% 8% 12% 14% 16% 18% 20% 0.8475 0.7182 0.980 0.9615 0.9434 0.9259 0.9091 0.8929 0.8772 0.8621 0.8333 0.8900 0.8573 0,7938 0.7432 0.6944 0.961 0.9246 0.8264 0.7972 0.7695 0.942 0.924 0.,906 0.8396 0.7118 0,6407 0.5787 3 0.8890 0.7513 0.6750 0.6086 0.6830 4 0.8548 0.7921 0.7350 0.6355 0.5921 0.5523 0.5158 0.4823 0.6209 0.8219 0.7473 0.6806 0.5674 0.5194 0.4761 0.4371 0.4019 0.888 0.7903 0.7050 0.6302 0.5645 0.5066 0.4556 0.4104 0.3704 0.3349 0.5835 0.5132 0.4523 0.3996 0.871 0.7599 0.6651 0.3538 0.3139 0.2791 0.7307 0.6274 0.2660 0.853 0.5403 0.4665 0.4039 0.3506 0.3050 0.2326 0.837 0.5002 0.4241 0.7026 0.5919 0.3606 0.3075 0.2630 0.2255 0.1938 10 0.820 0.6756 0.5584 0.4632 0.3855 0.3220 0.2697 0.2267 0.1911 0.1615 11 0.804 0.6496 0.5268 0.4289 0.3505 0.2875 0.2366 0.1954 0.1619 0.1346 12 0.788 0.6246 0.4970 0.3971 0.3186 0.2567 0.2076 0.1685 0.1372 0.1122 13 0.773 0.6006 0.4688 0.3677 0.2897 0.2292 0.1821 0.1452 0.1163 0.0935 14 0.758 0.5775 0.4423 0.3405 0.2633 0.2046 0.1597 0.1252 0.0985 0.0779 15 0.743 0.5553 0.4173 0.3152 0.2394 0.1827 0.1401 0.1079 0.0835 0.0649 16 0.728 0.5339 0.3936 0.2919 0.2176 0.1631 0.1229 0.0930 0.0708 0.0541 17 0.714 0.5134 0.3714 0.2703 0.1978 0.1456 0.1078 0.0802 0.0600 0.0451 18 0.700 0.4936 0.3503 0.2502 0.1799 0.1300 0.0946 0.0691 0.0508 0.0376 19 0.686 0.4746 0.3305 0.2317 0.1635 0.1161 0.0829 0.0596 0.0431 0.0313 20 0.673 0.4564 0.3118 0.2145 0.1486 0.1037 0.0728 0.0514 0.0365 0.0261 21 0.660 0.4388 0.2942 0.1987 0.1351 0.0926 0.0638 0.0443 0.0309 0.0217 0.1839 22 0.647 0.4220 0.2775 0.1228 0.0826 0.0560 0.0382 0.0262 0.0181 0.634 0.4057 0.2618 23 0.1703 0.1117 0.0738 0.0491 0.0329 0.0222 0.0151 0.622 24 0.3901 0.2470 0.1577 0.1015 0.0659 0.0431 0.0284 0.0188 0.0126 0.3751 25 0.610 0.2330 0.1460 0.0923 0.0588 0.0378 0.0245 0.0160 0.0105 0.1741 0.0116 30 0.552 0.3083 0.0994 0.0573 0.0334 0.0196 0.0070 0.0042 35 0.500 0.2534 0.1301 0.0676 0.0356 0.0189 0.0102 0.0055 0.0030 0.0017 0.0053 40 0.453 0.2083 0.0972 0.0460 0.0221 0.0107 0.0026 0.0013 0.0007 45 0.410 0.1712 0.0727 0.0313 0.0137 0.0061 0.0027 0.0013 0.0006 0.0003 0.1407 50 0.372 0.0543 0.0213 0.0085 0.0035 0.0014 0.0006 0.0003 0.0001

Step by Step Solution

3.36 Rating (168 Votes )

There are 3 Steps involved in it

a The maximum price to pay for the stock is the present value of the future cash fl... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

98-B-M-A-D-M (484).docx

120 KBs Word File