Question: Use the data in Exhibit 12-5. Suppose the partnership of Lauren, Andrews, and Benroudi liquidates by selling all noncash assets for $80,000. Complete the liquidation

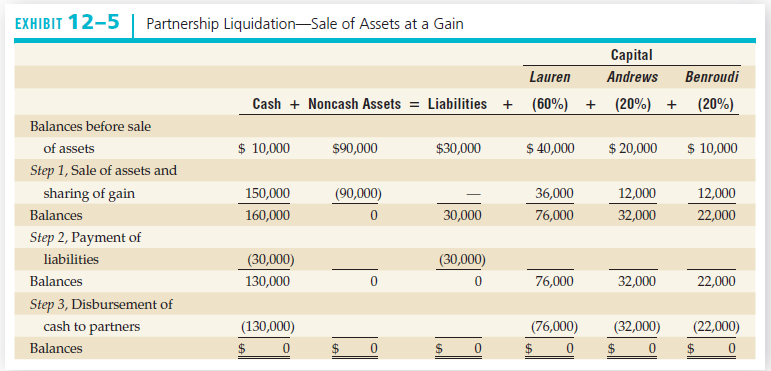

Use the data in Exhibit 12-5. Suppose the partnership of Lauren, Andrews, and Benroudi liquidates by selling all noncash assets for $80,000. Complete the liquidation schedule as shown in Exhibit 12-5.

EXHIBIT 12-5 Partnership Liquidation-Sale of Assets at a Gain Capital Lauren Andrews Benroudi (20%) + Cash + Noncash Assets = Liabilities + (60%) + (20%) Balances before sale $ 10,000 $ 40,000 $ 20,000 $ 10,000 of assets $90,000 $30,000 Step 1, Sale of assets and sharing of gain 12,000 150,000 (90,000) 36,000 12,000 160,000 22,000 Balances 30,000 76,000 32,000 Step 2, Payment of liabilities (30,000) (30,000) 76,000 Balances 130,000 32,000 22,000 Step 3, Disbursement of cash to partners (32,000) (130,000) (76,000) (22,000) Balances %24

Step by Step Solution

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Loss 90000 80000 10000 Lauren 10000 060 6000 Andrews ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1147-B-A-C(1137).docx

120 KBs Word File