Question: Using the data in problem 2, how much would you have paid to purchase an Australian dollar put option contract with a strike price of

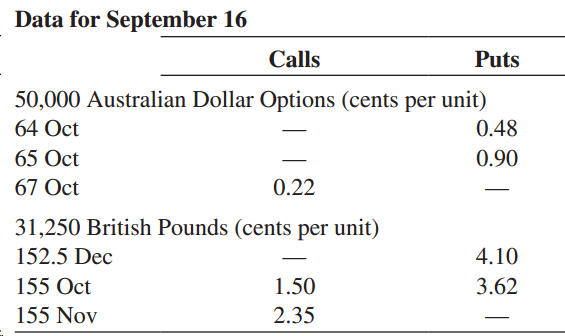

Using the data in problem 2, how much would you have paid to purchase an Australian dollar put option contract with a strike price of 65 and an October maturity?

Data from problem 2:

Given the following information, how much would you have paid on September 16 to purchase a Brit-ish pound call option contract with a strike price of 155 and a maturity of October?

Data for September 16 Calls Puts 50,000 Australian Dollar Options (cents per unit) 64 Oct 0.48 65 Oct 0.90 67 Oct 0.22 31,250 British Pounds (cents per unit) 152.5 Dec 4.10 155 Oct 1.50 3.62 155 Nov 2.35

Step by Step Solution

3.45 Rating (171 Votes )

There are 3 Steps involved in it

The correct price on September 16 for an Australian d... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

116-B-B-F-C (22).docx

120 KBs Word File