Question: Using the following financial statements for Eagle Company, compute the required ratios: Financial Statement Analysis Required A. What is the rate of return on total

Using the following financial statements for Eagle Company, compute the required ratios:

Financial Statement Analysis

Required

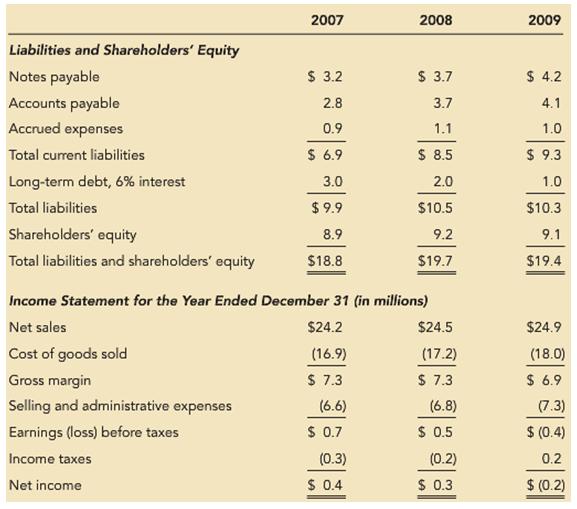

A. What is the rate of return on total assets for 2009?

B. What is the current ratio for 2009?

C. What is the quick (acid-test) ratio for 2009?

D. What is the profit margin for 2008?

E. What is the profit margin for 2009?

F. What is the inventory turnover for 2008?

G. What is the inventory turnover for 2009?

H. What is the rate of return on stockholders’ equity for 2008?

I. What is the rate of return on stockholders’ equity for 2009?

J. What is the debt-equity ratio for2009?

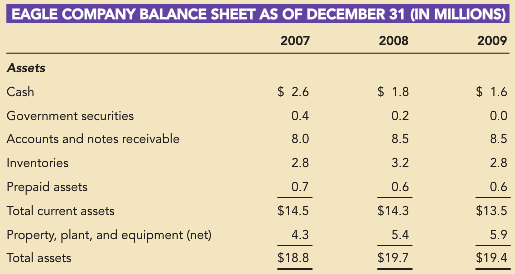

EAGLE COMPANY BALANCE SHEET AS OF DECEMBER 31 (IN MILLIONS) 2007 2008 2009 Assets Cash $ 2.6 $ 1.8 $ 1.6 Government securities 0.4 0.2 0.0 Accounts and notes receivable 8.0 8.5 8.5 Inventories 2.8 3.2 2.8 Prepaid assets 0.7 0.6 0.6 Total current assets $14.5 $14.3 $13.5 Property, plant, and equipment (net) 4.3 5.4 5.9 Total assets $18.8 $19.7 $19.4

Step by Step Solution

3.42 Rating (171 Votes )

There are 3 Steps involved in it

A B C D E F G H Rate of return on stockholders equity year 2008 I Rate of ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

420-B-M-A-F-S-A (2983).docx

120 KBs Word File