Question: Using the Hirsa-Madan model proposed in Section 23.4.4 to calibrate the following table of out-of-the-money WMT put option premiums. 9 What is the option markets

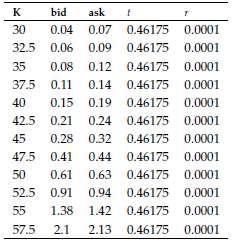

Using the Hirsa-Madan model proposed in Section 23.4.4 to calibrate the following table of out-of-the-money WMT put option premiums. 9 What is the option markets belief of the firm's default probability? Assuming the recovery forWMT is 40%, use the credit triangle formula to estimate an approximate credit spread. Suppose you knew the traded credit spread was 50 bps. Comment on the accuracy of the option implied credit spread and the consistency of expectations in the equity and credit markets.

bid askf 30 0.04 0.07 0.46175 0.0001 32.5 0.06 0.09 0.46175 0.0001 35 0.08 0.12 0.46175 0.0001 37.5 0.11 0.14 0.46175 0.0001 40 0.15 0.19 0.46175 0.0001 42.5 0.21 0.24 0.46175 0.0001 45 0.28 0.32 0.46175 0.0001 47.5 0.41 044 0.46175 0.0001 50 0.61 0.63 0.46175 0.0001 52.5 0.91 0.94 0.46175 0.0001 55 1.38 142 0.46175 0.0001 57.5 2.1 2.13 0.46175 0.0001

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

The following code can be used to apply the HirsaMadan model to calibrate the options above This led ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

912-B-F-F-M (5132).docx

120 KBs Word File