Question: Using the information for Otis, Inc., in SE and SE, compute current ratio, quick ratio, receivable turnover, days sales uncollected, inventory turnover, days inventory on

Using the information for Otis, Inc., in SE and SE, compute current ratio, quick ratio, receivable turnover, days’ sales uncollected, inventory turnover, days’ inventory on hand, payables turnover, and days’ payable for 2011 and 2012. Inventories were $8,000 in 2010, $10,000 in 2011, and $14,000 in 2012. Accounts receivable were $12,000 in 2010, $16,000 in 2011, and $20,000 in 2012. Accounts payable were $18,000 in 2010, $20,000 in 2011, and $24,000 in 2012. The company had no marketable securities or prepaid assets. Comment on the results. (Note: Round computations to one decimal place.)

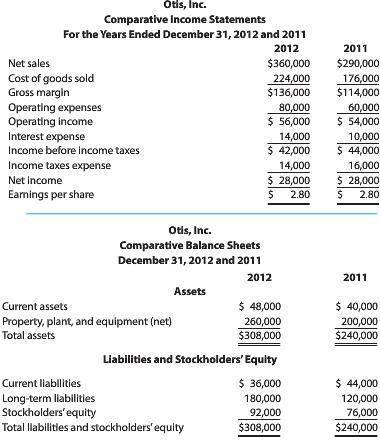

In SE, The comparative income statements and balance sheets of Otis, Inc., appear below. Compute the amount and percentage changes for the income statements and comment on the changes from 2011 to 2012. (Round the percentage changes to one decimal place.

Otis, Inc. Comparative Income Statements For the Years Ended December 31, 2012 and 2011 2012 2011 Net sales Cost of goods sold Gross margin Operating expenses Operating income Interest expense Income before income taxes Income taxes expense Net income Earnings per share 360,000 $290,000 224,000 176,000 136,000 $114,000 60,000 S 56,000 54,000 10,000 42,000 44,000 16,000 $ 28,000 28,000 $2.80 2.80 80,000 14,000 14,000 Otis, Inc. Comparative Balance Sheets December 31, 2012 and 2011 2012 2011 Assets 48,000 260,000 $308,000 Current assets Property, plant, and equipment (net) Total assets S 40,000 200,000 $240,000 Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Stockholders'equity Total liabilitles and stockholders'equity 44,000 120,000 76,000 $240,000 92,000

Step by Step Solution

3.37 Rating (172 Votes )

There are 3 Steps involved in it

In most regards Otis seems to have adequate liquidity Both the current and ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

328-B-A-G-F-A (3901).docx

120 KBs Word File