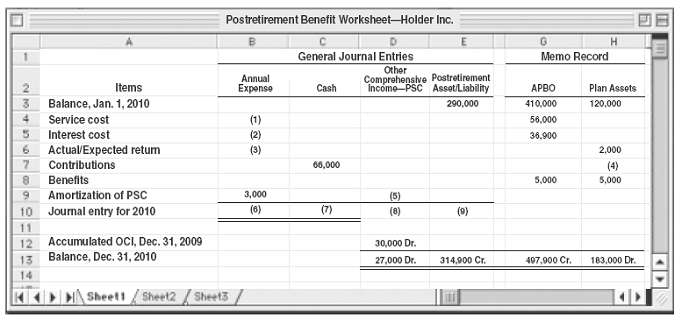

Question: (Postretirement Benefit Worksheet) Using the information in *E20-22, prepare a worksheet inserting January 1, 2010, balances, showing December 31, 2010, balances, and the journal entry

(Postretirement Benefit Worksheet) Using the information in *E20-22, prepare a worksheet inserting January 1, 2010, balances, showing December 31, 2010, balances, and the journal entry recording postretirement benefit expense.

(a) Determine the missing amounts in the 2010 postretirement worksheet, indicating whether the amounts are debits or credits.

(b) Prepare the journal entry to record 2010 postretirement expense for Holder Inc.

(c) What discount rate is Holder using in accounting for the interest on its other postretirement benefit plan? Explain.

2 Items 3 Balance, Jan. 1, 2010 4 Service cost 5 Interest cost 6 Actual/Expected return Contributions 7 8 Benefits 9 Amortization 10 11 12 13 14 of PSC Journal entry for 2010 Accumulated OCI, Dec. 31, 2009 Balance, Dec. 31, 2010 Postretirement Benefit Worksheet-Holder Inc. B C General Journal Entries Sheet1/Sheet2 Sheets Annual Expense (1) (2) (3) 3,000 (6) Cash 66,000 (7) Other Comprehensive Postretirement Income PSC Asset/Liability 290,000 (5) (8) E 30,000 Dr. 27,000 Dr. (9) 314,900 Cr. G Memo Record APBO 410,000 56,000 36.900 5,000 497,900 Cr. H Plan Assets 120,000 2,000 (4) 5,000 183,000 Dr. 11

Step by Step Solution

3.32 Rating (164 Votes )

There are 3 Steps involved in it

a Below is the completed worksheet indicating debit and credit entries Balance ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-P-P-B (73).docx

120 KBs Word File