Question: Using the information in P4- 3 and P4- 4, perform the following steps for Herman and Sons: Journal Entries; Post to the General Ledger; Prepare

Using the information in P4- 3 and P4- 4, perform the following steps for Herman and Sons’:

Journal Entries; Post to the General Ledger; Prepare a Trial Balance. Herman and Sons’ Law Offices opened on January 1, 2015. During the first year of business, the company had the following transactions:

• January 2: The owners invested $ 250,000 (the par value of the stock) into the business and acquired 25,000 shares of common stock in return.

• January 15: Herman and Sons’ bought an office building in the amount of $ 80,000. The company took out a long- term note from the bank to finance the purchase.

• February 12: Herman and Sons’ billed clients for $ 60,000 of services performed.

• March 1: Herman and Sons’ took out a two- year insurance policy, which it paid cash for in the amount of $ 22,000.

• March 10: Herman collected $ 20,000 from clients toward the outstanding accounts receivable balance.

• May 13: Herman received cash payments totaling $ 210,000 for legal services—$ 40,000 was for services previously billed to customers on February 12 and the remainder was for services provided in May not yet recorded.

• June 10: Herman purchased office supplies in the amount of $ 35,000, all on credit.

• July 15: Herman paid wages of $ 16,000 in cash to office staff workers.

• August 8: Herman paid off the $ 35,000 balance owed to a supplier for the purchase made on June 10.

• September 3: Herman and Sons’ purchased $ 25,000 of office supplies in cash.

• September 20: The Company paid $ 11,000 cash for utilities.

• October 1: Herman and Sons’ paid wages in the amount of $ 24,000 to office workers.

• December 1: Herman and Sons’ received cash payments from clients in the amount of $ 320,000 for ser-vices to be performed in the upcoming months.

• December 31: Herman declared and paid a $ 10,000 dividend.

Required

a. Journalize and post the necessary closing entries at year- end.

b. Prepare a post- closing trial balance as of December 31, 2015.

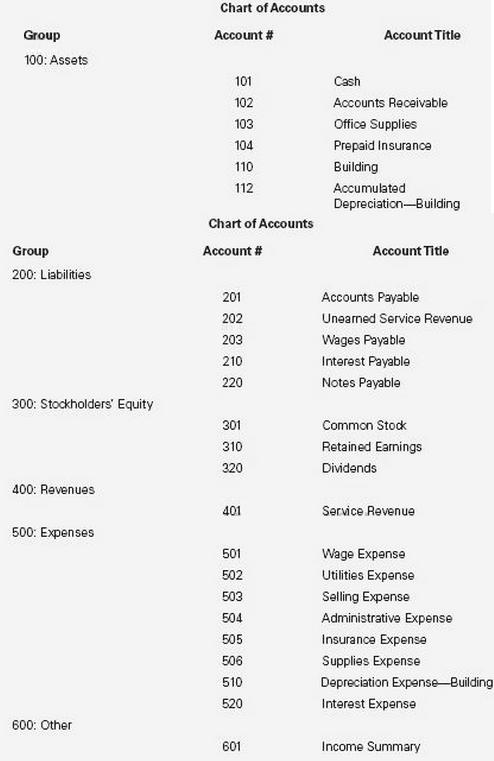

Chart of Accounts Group Account # Account Title 100: Assets 101 102 103 104 110 112 Cash Accounts Recaivable Office Supplies Prepaid Insurance Building Accumulated Depreciation-Building Chart of Accounts Group Account # Account Title 200: Liabilities 201 202 203 210 220 Accounts Payable Uneaned Service Revenue Wages Payable Interest Payable Notes Payable 300: Stockholders' Equity 301 310 320 Common Stock Retained Earnings Dividends 400: Revenues 401 Service Revenue 500: Expenses 501 502 503 504 505 506 510 520 Wage Expense Utilities Expense Selling Expense Administrative Expense Insurance Expense Supplies Expense Depreciation Expense -Building Interest Expense 600: Other 601 Income Summary

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

a ACCOUNT DEBIT CREDIT Service Revenue 390000 Income Summary 390000 ACCOUNT DEBIT CREDIT Income Summary 148167 Wage Expense 72000 Insurance Expense 91... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

578-B-A-B-S-C-F (1857).docx

120 KBs Word File