Question: Using the information provided in BE22-5, prepare the financing activities section of Larrys Luggage Companys cash flow statement assuming that Larrys Luggage reports under IFRS.

Using the information provided in BE22-5, prepare the financing activities section of Larry’s Luggage Company’s cash flow statement assuming that Larry’s Luggage reports under IFRS. Larry’s Luggage classifies interest paid as a financing activity and interest received as an investing activity. Larry’s Luggage made payments of $ 2,000 on its notes payable.

In BE22-5

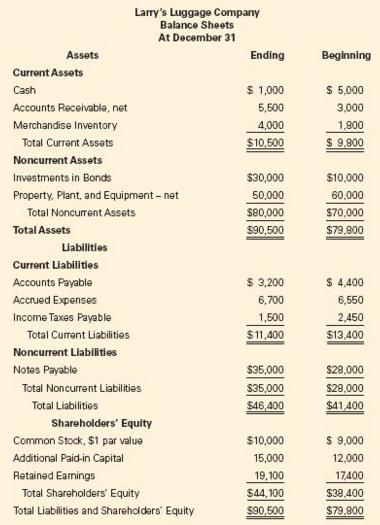

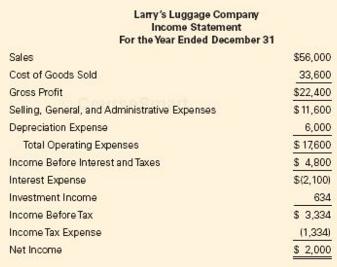

Larry's Luggage Company Balance Sheets At December 31 Property, Plant, and Equipment-net Income Taxes Payable Total Current Liabilities Noncurrent Liabilities Total Noncurrent Liabilities Shareholders Equity Common Stock, $1 par value Total Liabilities and Sharehclders Equity Larmry's Luggage Company Income Statement For the Year Ended December 31 Sales Cost of Goods Sold Gross Profit Selling. General, and Administrative Expenses Depreciation Expense Total Operating Expenses Income Before Interest and Taxes Interest Expense Investment Income Income Before Tax Income Tax Expense Net Income $56,000 33,600 $22,400 $11,600 6,000 $ 17600 $ 4,800 $12,100 634 $ 3.334 (1,334 2,000

Step by Step Solution

3.30 Rating (168 Votes )

There are 3 Steps involved in it

Financing Activities Issued Notes Payable 9000 Repayment of Notes Payable given 2000 Issue... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

578-B-A-B-S-C-F (1955).docx

120 KBs Word File