Question: Using the information provided in E22-15, prepare Cuthberts current- year statement of cash flows under the direct reporting format. In E22-15 Cuthbert Cookware Distributors, Inc.

Using the information provided in E22-15, prepare Cuthbert’s current- year statement of cash flows under the direct reporting format.

In E22-15

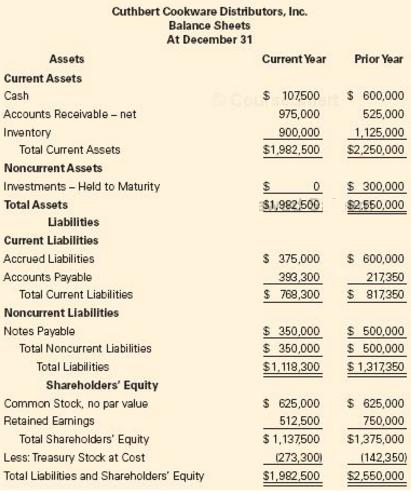

Cuthbert Cookware Distributors, Inc. is a wholesale distributor of brand- name cookware products. The company’s current- year comparative balance sheets and income statement are presented below.

Cuthbert Cookware Distributors, Inc.

Income Statement

For the Year Ended December 31

Current Year

Sales Revenue……………………………………… $ 2,800,000

Cost of Goods Sold………………………………... (1,875,000)

Selling, General, and Administrative Expenses……. (885,000)

Depreciation Expense 0 Bad Debt Expense……….. (10,000)

Loss on Sale of Investments……………………….. (37,500)

Interest Expense – net……………………………… (5,000)

Loss before Tax…………………………………….. $ (12,500)

Tax at 40% 0 Net Loss……………………………... $ (12,500)

Cuthbert Cookware Distributors, Inc. Balance Sheets At December 31 Assets Current Year Prior Year Current Assets S 107500 600,000 525,000 1.125,000 $1.982,500 2,250,000 Accounts Receivable net Inventory 975,000 900,000 Total Current Assets NoncurrentAssets Investments Held to Maturity Total Assets 0 300,000 $1,982 500 $2.550,000 Liabilities Current Liabilities Accrued Liabilities Accounts Payable 375,000 600,000 393 300 21/390 $ 769.300 S 817350 Total Current Liabilities Noncurrent Liabilities Notes Payable 350,000 S500,000 S 350,000 500,000 S1,118,300 $1,317,350 Total Noncurrent Liabilities Total Liabilities Shareholders' Equity Common Stock, no par value Retained Earnings Total Shareholders' Equity Less: Treasury Stock at Cost Total Liabilities and Shareholders' Equity S 625,000 625,000 512,500750,000 $ 1,137500 $1375,000 273300 142350 $1,982,500 $2,550,000

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

The first step in the solution is to isolate all balance sheet changes and classify the changes as operating investing or financing Analysis of Balanc... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

578-B-A-B-S-C-F (1963).docx

120 KBs Word File