Question: Using the market data in Exhibit 7.6, show the net terminal value of a long position in one 108.5 Sep Japanese yen European call contract

Using the market data in Exhibit 7.6, show the net terminal value of a long position in one 108.5 Sep Japanese yen European call contract at the following terminal spot prices, cents per yen: 106, 108, 108.5, 110, and 112. Ignore any time value of money effect.

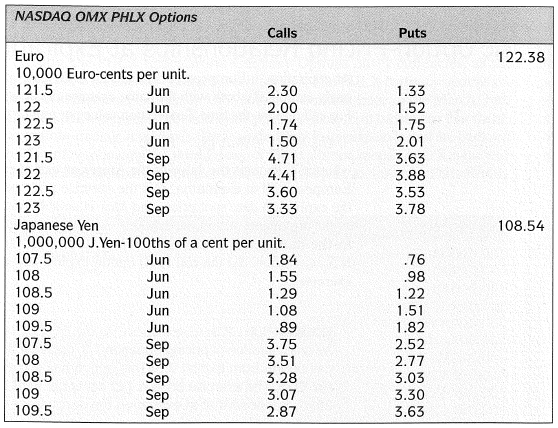

Exhibit 7.6

NASDAQ OMX PHLX Options Calls Puts Euro 122.38 10,000 Euro-cents per unit. 121.5 2.30 1.33 Jun 122 1.52 Jun Jun 2.00 122.5 1.74 1.75 123 Jun 1.50 2.01 121.5 122 Sep Sep Sep Sep 3.63 3.88 4.71 4.41 3.60 122.5 123 3.53 3.33 3.78 Japanese Yen 1,000,000 J.Yen-100ths of a cent per unit. 107.5 108.54 Jun 1.84 .76 108 Jun Jun 1.55 .98 108.5 1.22 1.51 1.29 109 Jun 1.08 109.5 107.5 Jun .89 1.82 Sep Sep Sep Sep Sep 3.75 2.52 108 3.51 3.28 2.77 108.5 3.03 3.30 109 3.07 109.5 2.87 3.63

Step by Step Solution

3.50 Rating (173 Votes )

There are 3 Steps involved in it

The net terminal value of one call contract is MaxS T E 0 C e x JPY1000000100 100 w... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

97-B-F-I-F-M (115).docx

120 KBs Word File