Question: Variable costing and absorption costing, the All-Fixed Company (R. Marple, adapted) It is the end of 2011. The All-Fixed Company began operations in January 2010.

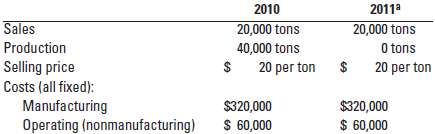

Variable costing and absorption costing, the All-Fixed Company (R. Marple, adapted) It is the end of 2011. The All-Fixed Company began operations in January 2010. The company is so named because it has no variable costs. All its costs are fixed; they do not vary with output. The All-Fixed Company is located on the bank of a river and has its own hydroelectric plant to supply power, light, and heat. The company manufactures a synthetic fertilizer from air and river water and sells its product at a price that is not expected to change. It has a small staff of employees, all paid fixed annual salaries. The output of the plant can be increased or decreased by adjusting a few dials on a control panel. The following budgeted and actual data are for the operations of the All-Fixed Company. All-Fixed uses budgeted production as the denominator level and writes off any production-volume variance to cost of goods sold.

a Management adopted the policy, effective January 1, 2011, of producing only as much product as needed to fill sales orders. During 2011, sales were the same as for 2010 and were filled entirely from inventory at the start of 2011.Required1. Prepare income statements with one column for 2010, one column for 2011, and one column for the two years together, using (a) variable costing and (b) absorption costing.2. What is the breakeven point under (a) variable costing and (b) absorption costing?3. What inventory costs would be carried in the balance sheet on December 31, 2010 and 2011, under each method?4. Assume that the performance of the top manager of the company is evaluated and rewarded largely on the basis of reported operating income. Which costing method would the manager prefer?Why?

2010 20,000 tons 40,000 tons 20 per ton 2011a 20,000 tons O tons 20 per ton Sales Production Selling price Costs (all fixed): Manufacturing Operating (nonmanufacturing) $320,000 $320,000 $ 60,000 $ 60,000

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Variable costing and absorption costing the AllFixed Company 1 The treatment of fixed manufacturing overhead in absorption costing is affected primarily by what denominator level is selected as a base ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

58-B-C-A-C-P-A (397).docx

120 KBs Word File